Monetary Policy Review

March 2010

The Monetary Policy Review (MPR) is published monthly by Bank Indonesia after the Board of Governors’ Meeting each February, March, May, June, August, September, November, and December. This report is intended as a medium for the Board of Governors of Bank Indonesia to present to the public the latest evaluation of monetary conditions, assessment and forecast for the Indonesian economy, in addition to the Bank Indonesia monetary policy response published quarterly in the Monetary Policy Report in January, April, July, and October. Specifically, the MPR presents an evaluation of the latest developments in inflation, the exchange rate, and monetary conditions during the reporting month and decisions concerning the monetary policy response adopted by Bank Indonesia.

Board of Governors

Darmin Nasution Deputi Gubernur Senior

Hartadi A. Sarwono Deputi Gubernur

Siti Ch. Fadjrijah Deputi Gubernur

S. Budi Rochadi Deputi Gubernur

Muliaman D. Hadad Deputi Gubernur

Ardhayadi Mitroatmodjo Deputi Gubernur

Table of Contents

I. Monetary Policy Statement ...3

II. The Economy and Monetary Policy ...6

Developments in the World Economy ...6

Economy Growth in Indonesia ...8

Inflation ...11

Rupiah Exchange Rate ...13

Monetary Policy ...15

Interest Rates ...15

Deposits, Credits, and Money Supply ...17

The Stock Market ...18

The Government Securities Market ...19

Mutual Funds Market ...20

Banking Conditions ...20

I. MONETARY POLICY STATEMENT

The process of global economic recovery continues to move forward, driven primarily by the economy of China. Bolstering China’s economic might is brisk investment growth, high levels of foreign direct investment (FDI) and comparatively strong bank lending. Economies in advanced nations have begun moving in a more optimistic direction, led by the US and Japan. The turnaround in the two economies is reflected in the rise in retail sales and manufacturing activity, which has helped bring down levels of unemployment. On the other hand, Europe’s economic recovery faces heavy challenges despite signs of renewed activity in manufacturing and initial improvement in retail sales. The fiscal crisis in Greece rooted in structural issues and high unemployment levels continue to daunt economic recovery in the region.

The Greek crisis has brought added pressure to bear on global financial markets with the strongest effects felt in emerging markets, including Indonesia. The fiscal crisis in Greece has triggered risk aversion among investors, who are shying away from emerging market assets and shifting investments back into safe haven assets. Reflecting this are lower yields on US treasury bonds and appreciation in the US dollar. The present investor behaviour has resulted in higher risk premia and prompted a downturn on global stock markets.

Global liquidity is now in abundant supply, prompting some central banks to begin phasing out their quantitative easing policies. Clearer signals of monetary tightening have surfaced in Asia. This is evident from steps taken by China and India to increase the minimum reserve requirement. In coming months, emerging markets are likely to pursue a more rapid exit strategy compared to developed countries, with management of foreign capital flows likely to pose extraordinary challenges.

industries. The rising income effect of manufacturing activity, spurred by exports, will strengthen public purchasing power.

The more conducive condition of the economy will also bring added investment, led by investment in infrastructure such as roads, ports and energy. The government has also begun taking action to address various regulations hampering investment. The objective is for the real sector to take optimum advantage of the momentum of international and domestic economic recovery. These developments have engendered strong optimism for the domestic economic outlook in 2010.

The solid condition of the balance of payments has kept the rupiah stable, despite pressure from negative external sentiment. During February 2010, the rupiah maintained more stable movement compared to the preceding month, reflecting in the drop in volatility from 0.96% in January to 0.3% in February. The rupiah closed February up 0.16% (p-t-p) at Rp 9,335 to the US dollar.

In the domestic financial sector, financial market performance has held at generally stable levels. On the money market, banks were comparatively well supplied with liquidity. The abundance of short-term liquidity resulted in the overnight interbank rate easing to levels approaching the lower corridor of the BI Rate. On the stock market, the JSX Composite underwent contraction mainly in response to negative external sentiment. The negative sentiment dragging down the JSX Composite is explained, among others, by the monetary tightening in China, worries over fiscal sustainability in Greece and lack of a clear global exit strategy. On the government securities market, yield moved in different directions according to individual tenor. Yields on short-term Government Securities eased further, contrasting with increases observed in medium and long tenor instruments. This development was linked mainly to unsettled external factors and the early effects of rising inflation expectations in 2010. Developments on the mutual funds market largely tracked performance in underlying assets. The indices for equity and mixed funds saw steep correction at 1.6% and 0.7% in contrast to the index for fixed income funds, which mounted further by 0.5%.

Monetary policy transmission in the financial sector has been limited. Although deposit and loan interest rates are in decline, the scale of lending remains limited. In January 2010, credit recorded negative growth, despite the positive growth measured on an annual scale. Looking forward, the downward trend in loan interest rates is expected to promote stronger credit expansion in 2010.

On the micro level, conditions in the national banking system remain stable. Reflecting this is the comfortably safe level of the capital adequacy ratio (CAR) alongside low non-performing loans (NPLs). In further developments, liquidity in the banking system, including the interbank money market, has progressively improved in tandem with growth in depositor funds.

this decision is that the 6.5% rate is consistent with the 5% ± 1% inflation target for 2010 and the current monetary policy stance is seen as conducive to economic recovery and the operation of the banking intermediation function.

II. THE ECONOMY AND MONETARY POLICY

The world economy is steadily improving even though overshadowed briefly by the fiscal crisis in Europe. Uncertainty over resolution of the fiscal crisis fuelled negative sentiment on global money markets that bore down on the domestic money market early in the month. The growing strength of the economic recovery in advanced nations (US and Japan) and Asia (China and India) has had a beneficial effect on Indonesia with the economy showing steady improvement and likely to outperform earlier forecasts for 2010. In regard to prices, inflation eased during the month under review and is forecasted to hold within the inflation targeting range for the year as a whole. The exchange rate has maintained relative stability despite a downturn early in the period under review, triggered by external factors. In regard to the banking system, various indicators continue to underscore the solid condition of Indonesia’s banks.

Developments in World Economy

The world economy is showing steady improvement overall,

despite persistent concerns over less conducive economic conditions in Europe. At this time, the global economy is still in recovery with emerging markets, led by Asia, providing the driving force for the world economy. Economies in advanced nations are improving as reflected in the steady rise in leading indicators for the US economy and the onset of decline in unemployment. Similar developments have taken place in the Japanese economy, reflected in rising industrial production. Alongside this, China’s economy, which has become the engine of world growth, continues to forge ahead. On the other hand, Europe’s economic growth lags behind the global economic recovery, due to the uncertainty surrounding actions to tackle the fiscal crisis in Greece.

this, retail sales have commenced an upward track, indicating the onset of recovery in the domestic economy. US retail sales were up 0.5% (mtm) in January 2010 (Graph 2.1), well ahead of the previous month (0.1%). Rising export demand has fuelled expansion in production sectors, in turn bring down levels of unemployment. It should also be noted that the US trade deficit soared in January 2010, due to rising imports and higher international oil prices. The US trade deficit now stands at 42.63 billion US dollars, the highest level in the past year. This suggests that momentum is beginning to return to the US economy.

Improvement in the Japanese economy is buoyed by rising exports

amid continued weak domestic consumption. The 40.9% (yoy) surge

in Japanese exports has reinvigorated the manufacturing sector, which in turn has stimulated demand for labour. Japanese household consumption is also showing an improving trend, although not as strong or stable as would be desired. Signs of Japanese consumer optimism are emerging, as evident in the improvement in Japanese consumer confidence from 37.9 to 39.4 during January 2010. Household sentiment also strengthened to 39 from 37.6 (December 2009). On the other hand, economic growth in Europe is lagging behind the pace of global recovery. European economies managed only 0.1% growth (qtq) in Q4/2009, following 0.4% (qtq) in the preceding quarter. The high downside risks in Europe’s economic growth caused industrial production to drop 1.7% (mtm) during December 2009 after charting positive growth at 1.4% (mtm) during the month before. Some European nations continue to be daunted by the threat of high unemployment. UK unemployment claims were up 23,500 in January 2010 with unemployment rising to 5%, the highest level since 1997. On one hand, consumption levels in Europe are no longer in decline, as visible in rising retail sales. Manufacturing is also gaining ground in keeping with the improvement in Europe’s exports. However, the high levels of unemployment and fiscal deficits in some European economies coupled with massive debts (mainly in the PIGS nations) are expected to block the path to further recovery.

For the time being, global financial market performance is impacted by uncertainty over the resolution of the fiscal crisis in Europe. The fiscal deficit in Greece has dampened risk appetite with investors shunning emerging market assets and returning to safe havens. Reflecting this are declining yields on US Treasury Bonds and appreciation in the US dollar, prompting a slide in global stock markets alongside a rise in risk premia. On the other hand, improving conditions in Asia, bolstered by more robust Graph 2.1 US Retail Sales

������������������

������������ ��

�

�

��

��

���

������

�������������������������������������� ������������

������������������

���� ���� ���� ���� ����

economic fundamentals, enabled the region’s financial markets to mount a swift recovery in the face of pressure from sentiment over the Greek crisis.

With the improvement in the global economy and upward trend in commodity prices, global inflationary pressures in 2010 are predicted to mount. The global inflation forecast for 2010 overall edged up slightly in February to 3.14% (yoy). Inflationary pressure in developing countries is estimated at 5.07% (yoy), down from 5.4% (yoy) in the IMF forecast. In advanced nations, inflation is expected to reach 1.61% (yoy), ahead of the IMF forecast at 1.3% (yoy). With inflationary pressure on the rise, emerging market nations are expected to shift more rapidly away from easing. In advanced nations, however, this process will take longer in view of the various issues yet to be resolved.

The predominant global monetary policy response has been to hold back from raising interest rates, with focus instead on management of money market liquidity. In February 2010, most major central banks, including the Fed and BoJ, kept rates on hold in efforts to stimulate domestic economic recovery. The Fed is keeping its policy rate in the 0%-0.25% range due to slack conditions on the labour market and low inflationary pressure. In Japan, the BoJ has held the reference rate at 0.1% and will not expand buying of securities. To fend off prolonged deflation, the Government of Japan has asked the BoJ to adopt a 1% inflation target. At the same time, amid the continuing improvement in the economy and the stable inflation outlook, the RBA has kept its policy rate steady at 3.75%. Definite signals of monetary tightening are becoming visible in developing nations, despite policy rates being kept on hold. In some Asian countries, such as China and India, signs of monetary tightening are already evident in decisions to raise the statutory reserve requirement. On 25 February 2010, China’s central bank raised the minimum reserve requirement by as much as 50bps to 16.5% in an attempt to curb inflation and mounting asset prices (Graph 2.2). These increases represent attempts by regulators to curb the rate of bank credit expansion while preparing the ground for further monetary tightening measures.

Economic Growth in Indonesia

The economy is predicted to chart higher growth in Q1/2010 in line with domestic and external demand. The continued improvement

Graph 2.2 China and India’s Monetary Policy

�������������������

� � � � � �� �� �� �� �� ��

������������������ ������������������� ��������������������� �����

��� ��� ��� ��� ��� ��� ��� ��� ���

���� ���� ���� ���� ����

����

����

in growth during the quarter is supported by positive indications from all aggregate demand components. The invigorated growth will be driven by stronger performance in exports and investment compared to earlier periods. The faster than predicted global economic recovery and improvement in international commodity prices is driving the upward trend in exports during Q1/2010. Investment is also forecasted to rise in response to increased demand while business tendencies have held firm. On the supply side, the improvement in sectoral performance at end-2009 is expected to carry forward into Q1/2010, bolstered by steadily rising external and domestic demand. Key sectors, such as manufacturing and the trade, hotels and restaurants sectors, have potential to chart stronger growth during Q1/2010. Despite this, agriculture may see reduced growth due to the shift in the harvest season to Q2/2010. Performance in other sectors, such as transport and communications and the electricity, gas and water utilities sector

Household consumption is expected to maintain brisk growth in Q1/2010. This forecast is consistent with developments in leading household consumption indicators, which currently point to improvement. Further evidence of upbeat growth in private consumption comes from movement in indicators for durable goods consumption and retail sales of non-durable goods (food and clothing). Private consumption has also been strengthened by improvement in income levels in export-oriented regions alongside sustained levels of consumer confidence. The planned 5% salary increase for civil servants, military and police and increases in the regional minimum wage in early 2010 may provided added boost to public purchasing power during the present quarter. However, when compared to the Q1/2009 period, household consumption is expected to chart reduced growth due to the high rates of spending by not-for-profit organisations in advance of the legislative elections (base effect factor). Support for the potential for higher household consumption in Q1/2010 is visible in the movement of some early indicators. Car sales were up 69.9% in January 2010, the strongest increase seen over the past year (yoy, Graph 2.3). During January, the retail sales index mounted by as much as 40.7% in annual terms (yoy, Graph 2.4). These gains were buoyed by consumption in the clothing and accessories category and in foods and tobacco. Also reflecting higher consumption growth were increases in consumer goods imports during January 2010 (Graph 2.5). In a similar vein, indicators linked to consumer financing, such as real M1 growth, are also showing a rising trend (Graph 2.6).

Graph 2.3 Growth of Vehicle Sales

��������

The continued pace of export growth is stimulating investment performance in Q1/2010. Higher investment levels are reflected in healthier growth for capital goods imports (Graph 2.7) and realised construction investment, as indicated by sustained high levels of cement consumption (Graph 2.8). Coupled with this, steady levels of business optimism buoyed by the outlook of increased international orders and selling prices also had a positive effect on investment growth during Q1/2010. Construction is again forecasted to be the major source of investment growth in Q1/2010. These indications of stronger investment growth are borne out in several leading investment indicators. Reflecting heightened investment growth are increases in capital goods imports and cement consumption. In January 2010, imports of capital goods were up 35.6% (yoy), which compares to 9.29% (yoy) one month earlier. In regard to construction investment, cement consumption charted significant growth in January 2010 at 13.25% (yoy). However, indications of more robust investment have not been matched by stronger financing, as indicated by the low level of real investment credit expansion (Graph 2.9).

With the improvement in the global economy and commodity prices, export growth is forecasted to rise. Indicators of rising trends in international market commodity prices, led by agricultural crops at 45.0% (yoy) and manufactured goods at 25.7% (yoy) have kept global trade running at high volume, as reflected in the Baltic Dry index (Graph 2.10). The upward trend in consumer confidence and business sentiment in the G3 nations and China also supports potential for increased export growth in Q1/2010. Reflecting this is the rising demand in advanced nations, led by the United States, and increased cargo loaded at Indonesia’s five main seaports. In disaggregation by sector and commodity category, non-oil and gas export growth continues to rely heavily on primary export commodities, including coal and other mining products and industrial products such as palm oil.

Import growth is predicted to climb in Q1/2010 in response to rising external and domestic demand. In the wake of the positive trend at year-end, imports are predicted to gather momentum on the strength of rising household consumption and demand for raw materials and capital goods for production in the manufacturing sector. Besides this, the current improvement in import growth is confirmed by more modest decline in import duties in January 2010 at -12.27% or Rp 1.25 trillion. In the wake of the ACFTA launching in January 2010, imports of

Graph 2.7 Growth of Imports of Capital Goods

manufactured products, such as Chinese textiles, are also expected to rise. The most important contribution to this import growth comes from increased imports of raw materials and intermediate inputs. Import growth in January 2010 was driven by increased imports of commodities related to capacity expansion, such as mechanical machinery/tools and electrical machines and equipment.

The improvement in sectoral performance is set to continue in Q1/2010 in keeping with the gains reported in some sectoral indicators. Key sectors, such as manufacturing and the trade, hotels and restaurants sectors, have potential to chart stronger growth during Q1/2010. Despite this, agriculture may see reduced growth due to the shift in the harvest season to Q2/2010. Robust performance is forecasted for other high-growth sectors such as transport and communications and the electricity, gas and water utilities sector. Key to buoyant growth in transport and communications is the ongoing high levels of performance in the telecommunications subsector.

Inflation

Monthly CPI inflation slowed in February 2010, despite an increase in the annual rate. Measured for the month, inflation in February reached 0.30% (mtm), down from 0.84% (mtm) in the preceding month. All inflation determinants supported the low inflation rate during the month under review. However, the annual inflation rate came to 3.81% (yoy), up from the earlier month recorded at 3.72% (yoy). Improving conditions in supply of foodstuffs compared to earlier periods has helped curb the intensity of inflationary pressures. Analysed by influencing factors, the current inflation is linked primarily to seasonal factors. At the same time, core inflation remained low, having eased in comparison to the preceding month. External pressure through the import channel remains minimal amid stability in the rupiah. On the domestic front, supply-demand interaction has not resulted in any general upward pressure on prices. In analysis by influencing factors, non-fundamentals were again the major factors driving CPI inflationary pressure during February 2010. Price movements for some volatile food commodities put further upward pressure on prices due to inconsistent levels of distribution from crop growing centres. On the other hand, fundamentals reflected in core inflation eased in comparison to the month before, a result of subdued Graph 2.9 Investment Credit and Gross Fixed

Capital Formation

Graph 2.10 Baltic Dry Index

��� ��� ��� ��� ������

Graph 2.11 Inflation

inflation expectations amid rising prices for some key commodities and recovery in purchasing power. Besides this, mild pressure from external factors coupled with the stability of the rupiah and a minimum output gap is consistent with the increased demand that has not driven up inflation.

CPI inflation in February, disaggregated by expenditure category, was driven primarily by food stuffs. The index rise in the food stuffs category is thought to be linked to strong pressure from rice prices, even though the low 0.13% contribution to inflation was down from the preceding month (0.35%). Another category with significant upward pressure on CPI inflation is the processed food category with a contribution of 0.07%. This is explained by prices for sugar and cooked rice (a derivative from milled rice) that drove up prices during the month under review.

Administered prices inflation during the month was minimal, due to the absence of increases in strategic items and of household

fuel shortages caused by the conversion programme. The minimum

impact of government decisions involving strategic administered prices, part of which resulted from the hike in electricity billing rates for customers with 6600 VA connections, kept monthly administered prices inflation during the month under review at 0.18%. Nevertheless, annualised inflationary pressure in administered prices mounted significantly to 2.26% from the previous month’s level of only -0.18%, due to the base effect of the fuel price cut in 2009. The dominant commodities contributing to inflation during the month under review were household fuels (0.01%) and cigarettes (0.02%. The rise in the household fuels price index is indicative of the absence of serious shortages in the implementation of the conversion programme. In 2010, the conversion programme will target a further 12.768 million households. As of 17 February, progress in the conversion had reached 4.3%. At the same time, the drop in non-subsidised fuel prices (Pertamax, Pertamax Plus, etc.) during the month under review had neutral impact on administered prices inflation.

With rice prices stable, volatile foods inflation eased in comparison to one month earlier (Graph 2.13). During February 2010, inflation in the volatile foods was recorded at 1.0% (mtm) or 5.19% (yoy). The moderate increase in rice prices over the previous month helped mitigate pressure in volatile foods inflation. This was expected with the onset of improved conditions in market supply, even still short of normal. As is widely known, the surge in rice prices during the preceding month

Graph 2.12 Inflation by Category of Goods and Services (%, mtm)

Graph 2.13 Volatile Food Inflation and Rice

is thought to be linked to soaring rice prices in inter island trade (rice shipped from Java) within a context of tight supply, leading to rapid price increases. Looking ahead, rice prices are predicted to fall in line with the seasonal trend as the harvest begins in March and April. Rice is therefore poised to become a deflater within the volatile foods category. Other pressures driving up prices came from commodities such as hot red chilli peppers and chicken meat. Prices increases for the two commodities are thought to have resulted from tight supply and distribution hurdles related to the monsoon season that brought severe flooding in some centres of production and major transport links. These two commodities contributed 0.02% and 0.01% to the inflation figure. At the same time, price increases for other international commodities had only limited impact on domestic food prices.

Measured overall, core inflation was down from the previous month due to the subdued levels of inflation expectations and mild pressure from external factors. Core inflation in February 2010 was recorded at 0.15% (mtm) or 3.88% (yoy), down from the preceding month’s levels of 0.59% (mtm) or 4.43% (yoy). From the external side, minimum pressure from international commodity prices as a whole (except sugar) alongside stability in the rupiah exchange rate kept external pressures at a low level. Inflation expectations were also mild, due to the absence of unfavourable shocks from external or domestic factors (Graph 2.14). In regard to the output gap, recovery in purchasing power accompanied by sustained levels of capacity utilisation generated a positive impact on levels of core inflation. In analysis by commodity, sugar accounted for a dominant contribution to core inflation, due to high prices commanded by internationally sourced raw material commodities and short supply (Graph 2.15). Sugar produced in an inflation contribution of 0.01%, down from the preceding month’s contribution at 0.06%. Another core commodity generating significant inflationary contribution was cooked rice and rice porridge. In a contrasting development, gold, a non-food core commodity, again produced a deflationary impact of 0.5% in the core category (Graph 2.16).

Rupiah Exchange Rate

After a downturn from pressure in early February, the rupiah

resumed appreciation towards the end of the month. Negative

Graph 2.15 International and Domestic Sugar Price

Graph 2.16 International and Domestic Gold Price

Graph 2.17 AverageRupiah Exchange Rate

sentiment early in the month over the fiscal deficit problems in Europe bore down on global financial markets with fallout affecting the value of the rupiah. However, this pressure was curbed with the release of reports of improving economic indicators in various regions pointing to continued recovery in the global economy. In response to these developments, the average value of the rupiah slipped 0.68% in February 2010 to Rp 9,338 to the US dollar compared to Rp 9,275 to the US dollar one month earlier (Graph 2.17). Although the rupiah underwent some turbulence, movement during the month under review was more stable compared to one month earlier. Reflecting this was the drop in volatility from 0.96% (January 2010) to 0.30% (Graph 2.18).

The secure condition of economic fundamentals bolstered by high returns on rupiah-denominated investments helped to keep investor risk perceptions at subdued levels. This was evident in the relatively stable indicators for investment risk in Indonesia, a factor that helped attract capital inflows. The result of this was to increase the available supply of foreign currency and maintain equilibrium in demand and supply on the domestic forex market.

Despite brief correction in early February 2010 in line with mounting pressures on global financial markets, indicators of investment risk in Indonesia showed improvement midway through the month. The EMBIG spread indicator eased to 311 bps in February 2010 compared to 323 bps one month earlier. Yield spread for Indonesia global bonds over US T-Notes similarly narrowed to 196 bps from 228 bps in the preceding month. The Credit Default Swap (CDS) spread, an indicator of risk in Indonesian bonds, improved narrowly from 190 bps in January 2010 to 189 bps in the month under review, consistent with CDS movement in other Asian emerging markets (Graph 2.21). Another risk indicator, the swap premium, maintained relatively stable movement indicative of low pressure on the rupiah exchange rate (Graph 2.22).

Attractive yields on rupiah investments, like before, shored up the rupiah and thus prevented excessive decline. The broader spread between domestic and international interest rates compared to several other nations in Asia helped attract foreign funds for investment. Uncovered Interest Rate Parity (UCIP) stood at 6.43% in February 2010, essentially stable when compared to the previous month’s level of 6.48%. Due to the improvement in risk indicators, Covered Interest Rate Parity (CIP), the risk indicator for interest rate differential after allowing for risk,

Graph 2.18 Rupiah Exchange Rate Volatility

Graph 2.19 Performance of Global Stock Markets

Graph 2.20 Appreciation/Depreciation Exchange Rate Average (February 2010 compare to January 2010)

was up from one month before. During the month under review, CPI stood at 4.47%, ahead of the previous month’s level of 4.21%. Investment returns on bonds, also higher compared to several other nations in Asia, also offered attraction for inflows of foreign capital into the domestic economy (Graph 2.23).

Monetary Policy

Interest Rates

Monetary policy transmission through the interest rate channel operated smoothly during February 2010. The average overnight rate on the interbank market came down 6 bps to 6.17% or 33 bps below the BI Rate, even though the BI Rate has held steady at 6.5% since August 2009. This was consistent with the flush condition of short-term liquidity that kept the overnight rate close to the lower limit of the interest rate corridor. This condition was subsequently transmitted to interbank rates in longer tenors. Interbank rates in above overnight tenors eased by approximately similar levels. The weighted average interbank rates in the 2-6, 7, 8-26 and 27-30 day tenors came down by 6-9 bps. However, weighted average interbank rates in above 30 day tenors moved up by 2 bps. The rise in interbank rates for over 30-day tenors is explained by thin volume and frequency of transactions. The decline of interbank rates in longer maturities carried over to bank time deposit rates, which also eased.

Liquidity conditions were stable in line with lower perceptions of risk. Key to this was the Bank Indonesia commitment to maintain adequate liquidity levels on the money market by means of open market operations (OMO) and standing facilities. The plentiful liquidity was matched by more even distribution of liquidity on the money market, reflected by the drop in the average spread between high and low overnight rates from 17 bps in January 2010 to 15 bps in February 2010.

SBIs are now structured more competitively in the wake of intensive efforts by BI to improve the SBI maturity profile. The SBI interest rate structure in February 2001 was a little steeper than one month before, a result of the steady decline in weighted average 1-month SBI rate. However, the weighted average 3-month and 6-month SBI rates held generally firm. As a result, the weighted average 1, 3 and 6-month Graph 2.21 Indonesia Risk Perception Indicator

Graph 2.22Premium Swap

SBI rates at end-February 2010 stood at 6.41%, 6.59% and 6.69%. The purpose of this is to offer more incentive to the banking system to hold funds in longer-tenor SBIs.

While the BI Rate remained unchanged, time deposit rates

maintained downward movement. From January to February 2010, the

1-month deposit rate showed indications of sustained decline. At the same time, banks were still visibly providing customers greater incentive to hold funds in longer-term placements. In December 2009 in particular, rates for 24-month deposits mounted by 4 bps, in contrast to the decline in other tenors. In analysis by bank category, the steepest drop in time deposit rates took place at state-owned banks over the period that the BI Rate has been kept on hold. Looking forward, deposit rates are predicted to ease further in keeping with the banking focus on lowering cost of funds.

BI Rate transmission to loan interest rates improved due to

softening perceptions of economic risk within the banking system. Reflecting this is the steady decline in cost of funds for the banking system and the narrowing spread for interest rates on working capital loans and investment credit measured against the BI Rate. Despite this, the present cost of funds for banks is still on the high side when compared to 2007-2008, even though the current BI Rate is below the level of that period. This condition is linked mainly to the realignment process for time deposit rates, in which deposit rates have held above the BI Rate level since the outbreak of the global crisis in October 2008. Improving perceptions of economic risk in the banking system are expected to bring more aggressive rate cuts for working capital credit. However, rates for consumption credit are predicted to see the least decline, due to the comparative lack of elasticity in this lending to movement in interest rates.

Table 2.1

Development of Various Interest Rates

Interest Rate (%)

BI Rate 8.75 8.25 7.75 7.5 7.25 7.00 6.75 6.50 6.50 6.50 6.50 6.50

Deposit Guarentee 9.50 9.00 8.25 7.75 7.75 7.50 7.25 7.00 7.00 7.00 7.00 7.00

1-month Deposit (Weighted Average) 10.52 9.88 9.42 9.04 8.77 8.52 8.31 7.94 7.43 7.38 7.16 6.87

Base Lending Rate 14.18 13.98 13.94 13.78 13.64 13.40 13.20 13.00 12.96 13.01 12.94 12.83

Working Capital Credit 15.23 15.08 14.99 14.82 14.68 14.52 14.45 14.30 14.17 14.09 13.96 13.69

Invesment Credit 14.37 14.23 14.05 14.05 13.94 13.78 13.58 13.48 13.20 13.20 13.03 12.96

Consumption Credit 16.46 16.53 16.46 16.48 16.57 16.63 16.66 16.62 16.67 16.53 16.47 16.42

2009

Deposits, Credits, and Money Supply

Aggregate funding growth in January 2010 is estimated lower keeping with the beginning of year historical trend. General factors slowing growth in depositor funds at the start of the year include servicing of corporate debt by the private sector, while the government again recorded net contraction due to the absence of major activity on government projects. However, funding growth was down in 2009 at 12.5% (yoy), a level that compares to the previous year’s growth of 16.1% (yoy). The overall depositor funds position mounted Rp 219.8 trillion to Rp 1,973.0 trillion.

Monetary policy transmission in the financial sector has been more limited. Although deposit and loan interest rates are in decline, the scale of lending is still constrained. In January 2010, credit recorded negative growth, despite the positive growth measured on an annual scale. This is an indication of initial improvement in annualised credit expansion, although it remains below the average for normal, non-crisis conditions (2006 until early 2008). The strengthening of the domestic economy has led to improved perceptions of economic risk in the banking system and prompted some easing in lending rates. The improving perceptions of economic risk are reflected in the downward trend in non-performing loans (NPLs) since Q3/2009.

Economic liquidity expanded at a more rapid pace, despite not having recovered to pre-crisis levels. Stronger growth in economic liquidity was reflected in annual growth in M1, M2 and Rupiah M2. In December 2009, M1, M2 and rupiah M2 registered 11.9%, 13.2% and 14.0% (yoy) growth, up from 6.8%, 11.5% and 13.0% (yoy) in the preceding month. As a result, the M1 position widened in December 2009 by Rp 14.2 trillion over the previous month to Rp 521.8 trillion. This rise is explained largely by more robust growth in demand deposits held by individuals and other private companies and is an early indication of invigorated economic activity in society. In similar developments, the M2 and rupiah M2 positions increased by Rp 78.9 trillion and Rp 82.8 trillion in line with addition to the quasi-money component.

Graph 2.24 Development of Various Interest Rates

Graph 2.25 Development of Funds, Credits, and BI Rate

Graph 2.26 Credit Growth by Usage

The Stock Market

The Bank Indonesia decision to hold the BI Rate at 6.5% in February 2010 signals the likelihood of no significant inflationary pressure during the first half of 2010. The Bank Indonesia stance translates into a measure to promote economic growth while keeping inflation on track with the inflation target for 2010. The Q4/2009 GDP Release in mid-February 2010 points to significant improvement in Indonesia’s economic performance during the fourth quarter of 2009, buoyed by an accommodative monetary policy. However, this commendable achievement carried less weight with movement in the JSX Composite Index, which in fact sustained contraction due to global pressures.

Dynamics on global financial markets were marked by a range of issues, including deficits in Europe, the plunging consumer confidence index in the US and the various open scenarios for a global exit policy. Developments in Europe rekindled jitters among global financial market actors over the issue of resolution of the fiscal problems of the PIGS nations (Portugal, Italy, Greece and Spain). In the US, financial markets were hit by worries over the drop in the US consumer confidence index, which dropped to a 10-month low. In Asia, the second hike in China’s minimum reserve requirement has sent out a signal that emerging markets will move forward with an exit policy ahead of other nations. These global financial market developments also put pressure on the domestic financial market, with the JSX Composite closing down 2.37% in February at the 2,540.03 mark.

The slide in the JSX Composite was followed by capital outflows and drop in stock market liquidity, albeit on a limited scale. This new development came in the wake of predictions that developing nations will opt for an exit policy ahead of advanced nations. This issue set off a round of capital outflows, although during the last week the inflows of capital began booking a net purchase. During February 2010, foreign investors recorded a net sale of Rp 1.82 trillion in contrast to the January 2010 net purchase of Rp 0.58 trillion. Accompanying this was a downturn in domestic market trading volume in February. Average trading volume dropped to Rp 3.69 trillion per day compared to the January average of Rp 3.95 trillion per day.

The downturn in the JSX Composite was also reflected in sectoral index performance. Correction sustained in the Composite index

Graph 2.27 Growth of Currency in Circulation (Nominal)

was replicated across almost all sectors, except multifarious industry, consumer goods, trade and agribusiness. Commodity-based sectors, such as mining and estates, had earlier been expected to shore up JSX Composite performance, but also suffered correction. The dip in mining came in response to the 9.3% rise in world oil prices in February 2010 and the 3.9% in the Baltic Dry index. In other developments, weaker activity in agribusiness was related to lower earnings performance reported in corporate balance sheets published by agribusiness companies.

The Government Securities Market

The Bank Indonesia decision to hold the BI Rate met with varying response on the Government Securities market. During February 2010, yield on short and medium-term Government Securities was relatively stable, easing only 0.01 bps. In contrast, yield on medium and long-term tenors was up by 5 bps. This is explained by conditions on global financial markets, which have entered a period of renewed turbulence in response to the dynamics of the economies in China, the US and Greece and the onset of rising inflation expectations in 2010.

The movement in mixed yield Government Securities was closely related to a combination of positive and negative risks on the Government Securities market during February 2010. External factors represented a negative contribution to Government Securities. Indications of this include a rise in the Emerging Market Bond Index Global (EMBIG) and negative sentiment over the worsening of the Greek fiscal crisis. At home, the factor driving negative sentiment was a renewed increase in inflation expectations in 2010. Countering this were other factors, such as sustainable fiscal management and the continued attractiveness of yields on Government Securities, which helped bolster activity in these instruments during February 2010.

Liquidity on the Government Securities market was relatively stable. Average trading volume in Government Securities was again stable at Rp 3.3 trillion per day. The increased activity on the Government Securities market was not matched by higher frequency in daily trading. Frequency of trading fell to 216 transactions per day in February 2010, which compares to the January 2010 level of 225 per day. Alongside this, foreign buyers expanded their holdings of Government Securities, in so doing booking a net purchase.

Graph 2.30 JCI and Average Trading Volume

������������ �

� � � � � ��

���� ���� ���� ���� ���� ����

� � � � ���� � � � � �� �� � � � � �� �� � � � � �� �� � � � � �� ���� �

�� �� ��

�������������������������������������� �������������������

Graph 2.31 Government Securities Volume

������������ �

� � � � � ��

���� ���� ���� ���� ���� ���� � �� �� ��

� � � � ���� � � � � ���� � � � � ���� � � � � ���� � � � � ������ ��������������������������������������

�������������������

Graph 2.32 Government Securities Trading Frequency

������������

� ����� ����� ����� ������ ������ ������

������������������������

���� ���� ���� ����

Mutual Funds Market

Deteriorating underlying assets performance, and for stocks in particular, caused mutual funds to sustain correction. Mutual fund categories affected by the correction included equity and mixed funds, in contrast to the modest gains in debt-based funds. Responding to these developments, equity and mixed funds underwent 1.6% and 0.7% correction in contrast to fixed income funds, which mounted further by 0.5%. Despite this, the correction in equity and mixed funds was still more moderate than the downturn on the stock exchange, which sustained 1.9% correction. This indicates that investment managers had achieved a healthy level of portfolio diversification in February 2010, thus keeping correction to a minimum.

Mutual funds based on medium term notes (MTNs) made significant strides during February 2010. These gains have been driven by keen interest from pension funds willing to invest in these products. However, this trend calls for some vigilance in view of the restriction imposed by Minister of Finance Regulation No. 199/2008 prohibiting pension funds from investing directly in MTNs, including MTNs packaged as securitised debt. Although the packaging of MTNs into mutual funds allows risk to be spread among investment managers and custodians, MTNs have historically suffered from high levels of default. To this end, the Capital Market and Financial Institutions Supervisory Agency (Bapepam-LK) has taken action to mitigate risk through a recording and rating mechanism and only permitting pension funds with minimum Rp 200 billion investment and adequate risk management to invest in mutual funds.

Condition of The Banking System

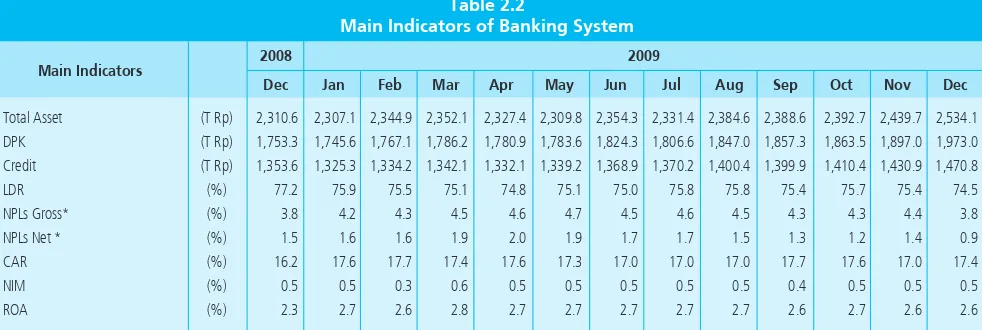

In the banking sector, performance remains generally sound. Key banking indicators, such as the capital adequacy ratio (CAR), the non-performing loans (NPLs) ratio, net interest margin (NIM) and return on assets (ROA), held firm at adequate, stable levels amid the present instability of global conditions. NPLs in January 2009 came well below the preceding month’s level at 3.8%. In a similar vein, the CAR remained solid at 17.4%, well above the 8% minimum prescribed by Bank Indonesia. ROA and NIM were also stable at 2.6% and 0.5% (Table 2.2).

Graph 2.33 Index of Discretionary Funds, Fixed Income Funds, and Equity Funds

������������������

� ����� ����� ����� ����� ����� ����� �����

������������������� ������������������ ������������

���� ���� ���� ���� ���� ���� ���� ���� ���� ����

III. MONETARY POLICY RESPONSE

On 4 March 2010, the Bank Indonesia Board of Governors Meeting decided to hold the BI Rate at 6.50%. In the view of the Board of Governors Meeting, the current level of the BI Rate at 6.50% remains consistent with achievement of the 5%±1% inflation target for 2010 and offers adequate support for the economic recovery and banking intermediation processes.

Table 2.2

Main Indicators of Banking System

Main Indicators

Total Asset (T Rp) 2,310.6 2,307.1 2,344.9 2,352.1 2,327.4 2,309.8 2,354.3 2,331.4 2,384.6 2,388.6 2,392.7 2,439.7 2,534.1 DPK (T Rp) 1,753.3 1,745.6 1,767.1 1,786.2 1,780.9 1,783.6 1,824.3 1,806.6 1,847.0 1,857.3 1,863.5 1,897.0 1,973.0 Credit (T Rp) 1,353.6 1,325.3 1,334.2 1,342.1 1,332.1 1,339.2 1,368.9 1,370.2 1,400.4 1,399.9 1,410.4 1,430.9 1,470.8

LDR (%) 77.2 75.9 75.5 75.1 74.8 75.1 75.0 75.8 75.8 75.4 75.7 75.4 74.5

NPLs Gross* (%) 3.8 4.2 4.3 4.5 4.6 4.7 4.5 4.6 4.5 4.3 4.3 4.4 3.8

NPLs Net * (%) 1.5 1.6 1.6 1.9 2.0 1.9 1.7 1.7 1.5 1.3 1.2 1.4 0.9

CAR (%) 16.2 17.6 17.7 17.4 17.6 17.3 17.0 17.0 17.0 17.7 17.6 17.0 17.4

NIM (%) 0.5 0.5 0.3 0.6 0.5 0.5 0.5 0.5 0.5 0.4 0.5 0.5 0.5

ROA (%) 2.3 2.7 2.6 2.8 2.7 2.7 2.7 2.7 2.7 2.6 2.7 2.6 2.6

2008 2009

Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

* Provisional Figures

* Using 2000 base year (BPS-Statistic Indonesia) 1) end of week

2) weighted average 3) end period closing 4) closed file

Sources : Bank Indonesia, except stock market data (BAPEPAM), CPI, export/import and GDP (BPS)

Latest Indicators

FINANCIAL SECTOR

P R I C E S

EXTERNAL SECTOR

QUARTERLY INDICATOR INTEREST RATE & STOCK

One month SBI 1) Three month SBI 1) One month Deposit 2) Three month Deposit 2) One week JIBOR 2) JSX Indices 3)

MONETARY AGGREGATES (billions Rp) Base Money

M1(C+D) Currency (C) Demand Deposit (D) Broad Money (M2 = C+D+T)

Quasi Money (T) Quasi Money (Rupiah) Time Deposit Saving Deposit Foreign Currency Deposit Broad Money Rupiah Claim on Business Sector Credit by DMBs

CPI - monthly (%, mtm) CPI - 1 year (%, yoy)

Rp/USD (endperiod,midrate) Non oil/gas Export (f.o.b, million USD) 4)

Non oil/gas Import (c$f, million USD) 4)

Net International Reserve (million USD)

Real GDP Growth (% y-o-y) Consumption Investment Changes in Stocks Export Import

9.50 8.74 8.21 7.59 7.25 6.95 6.71 6.58 6.48 6.49 6.47 6.46 6.45

-9.93 9.25 8.61 7.95 7.39 7.05 6.79 6.63 6.55 6.60 6.59 6.59 6.60

-10.52 9.89 9.42 9.04 8.77 8.52 8.31 7.94 7.43 7.38 7.16 6.87 -

-11.34 11.13 10.65 10.09 9.68 9.25 8.99 8.73 8.35 7.97 7.68 7.48 -

-9.43 8.71 8.30 8.03 7.69 7.09 6.96 6.56 6.46 6.46 6.47 6.46 6.45

-1,333 1,285 1,434 1,723 1,917 2,027 2,323 2,342 2,468 2,368 2,416 2,534 2,611

314,662 303,777 304,718 308,277 309,232 322,994 322,850 324,663 354,297 364,869 376,938 402,118 384,176

437,388 434,233 448,452 454,221 455,364 483,053 469,346 490,575 490,501 485,979 495,554 506,055 - -

191,339 186,611 186,538 191,194 192,143 203,838 201,172 200,871 210,822 206,305 212,547 226,382 209,993

246,049 247,622 261,914 263,027 263,221 279,215 268,174 289,704 279,679 279,674 283,007 279,673 -

1,754,293 1,773,980 1,794,004 1,794,888 1,807,388 1,859,690 1,841,112 1,871,955 1,889,157 1,900,907 1,928,840 2,002,990 -

1,316,905 1,339,747 1,345,553 1,340,667 1,352,024 1,376,637 1,371,766 1,381,381 1,398,656 1,414,928 1,433,286 1,496,935 -

1,175,565 1,190,990 1,202,724 1,205,976 1,217,906 1,245,822 1,245,247 1,251,225 1,272,217 1,285,497 1,297,781 1,359,001 -

686,919 703,027 706,002 705,379 715,139 726,088 724,888 727,889 731,202 741,072 738,118 755,996 -

488,645 487,964 496,722 500,597 502,767 519,733 520,359 523,336 541,015 544,425 559,663 603,005 -

141,341 148,757 142,828 134,691 134,118 130,815 126,519 130,156 126,439 129,431 135,505 137,934 -

1,612,953 1,625,223 1,651,176 1,660,197 1,673,270 1,728,875 1,714,594 1,741,800 1,762,718 1,771,476 1,793,335 1,865,056 -

1,391,619 1,403,408 1,401,342 1,387,947 1,392,747 1,419,799 1,435,290 1,465,870 1,463,662 1,478,447 1,503,304 1,543,901 -

1,293,600 1,305,681 1,303,885 1,292,306 1,298,095 1,320,131 1,333,469 1,351,511 1,348,857 1,361,096 1,383,567 1,408,669 -

--0.07 0.21 0.22 -0.31 0.04 0.11 0.45 0.56 1.05 0.19 -0.03 0.33 0.84 0.30

9.17 8.60 7.92 7.31 6.04 3.65 2.71 2.75 2.83 2.57 2.41 2.78 3.72 3.81

11,355 11,980 11,575 10,713 10,340 10,225 9,920 10,060 9,681 9,545 9,480 9,400 9,365 9,335

6,345 6,713 7,473 7,053 8,229 8,470 8,437 8,966 8,200 9,714 8,678 11,048 -

-5,706 5,008 5,819 5,488 6,366 6,987 7,720 7,313 5,589 7,405 7,109 8,044 -

-47.96 47.17 50.68 51.72 51.65 50.99 50.72 50.84 53.81 55.68 56.15 57.69 61.59 62.14

4.53 4.08 4.16 5.43

7.28 6.27 5.44 5.91

-0.92 3.01 4.35 4.49

-148.07 97.07 90.63 6.24

-18.73 -15.52 -7.79 3.67

-24.42 -21.04 -14.67 1.62

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb

2009 2010