Full Terms & Conditions of access and use can be found at

http://www.tandfonline.com/action/journalInformation?journalCode=ubes20

Download by: [Universitas Maritim Raja Ali Haji] Date: 12 January 2016, At: 17:44

Journal of Business & Economic Statistics

ISSN: 0735-0015 (Print) 1537-2707 (Online) Journal homepage: http://www.tandfonline.com/loi/ubes20

Foreign Technology Transfer and Productivity

Mahmut Yasar & Catherine J Morrison Paul

To cite this article: Mahmut Yasar & Catherine J Morrison Paul (2008) Foreign Technology Transfer and Productivity, Journal of Business & Economic Statistics, 26:1, 105-112, DOI: 10.1198/073500107000000197

To link to this article: http://dx.doi.org/10.1198/073500107000000197

Published online: 01 Jan 2012.

Submit your article to this journal

Article views: 105

View related articles

Foreign Technology Transfer and Productivity:

Evidence From a Matched Sample

Mahmut Y

ASARDepartment of Economics, University of Texas at Arlington, Arlington, TX 76019 (myasar@uta.edu)

Catherine J. M

ORRISONP

AULDepartment of Agricultural and Resource Economics and the Giannini Foundation, University of California, Davis, CA 95616 (cjmpaul@primal.ucdavis.edu)

We examine the causal effects of alternative foreign technology transfer channels on the productivity of Turkish manufacturing plants, using propensity score matching techniques that limit implicit assumptions about plant homogeneity and self selection imbedded in standard estimates of such effects. We find posi-tive impacts of technology transfer through foreign direct investment (FDI), exporting, and importing on both total factor and labor productivity, with FDI dominating and importing the least significant. Further, although internationally linked plants on average exhibit better productivity and differing characteristics than domestic plants before matching, the closeness of the matching indicates that remaining productivity gaps are caused by foreign technology transfer.

KEY WORDS: Causality; Exports; Foreign direct investment; Imports; Plant performance.

1. INTRODUCTION

Productivity deviations among countries, industries, and firms or plants can stem from a variety of factors in addition to differing technical change. In particular, international dif-fusion of technology, especially across countries at different stages of development, may affect productivity. Such effects are consistent with a premise of the endogenous growth litera-ture that trade enhances growth because international linkages give firms access to new technology. This facilitates learning and contributes to firms’ productivity and thus competitiveness with other global players in world markets.

Channels through which technology diffusion or transfer may occur include importing intermediate or capital goods that embody new technology, “learning by exporting” products that imitate other countries’ technology, and foreign direct invest-ment (FDI) that results in knowledge flows from R&D and training for domestic employees. Various studies have exam-ined the hypothesis that technology transfer through these chan-nels enhances productivity.

Coe and Helpman (1995), Xu and Wang (1999), and Eaton and Kortum (1996), for example, found significant productiv-ity effects at the country level from importing technology, and Keller (2002a,b) supported this conclusion with industry-level data. Results from micro data are more mixed; Kraay, Soalaga, and Tybout (2001) and Keller and Yeaple (2003) found little evidence of importing effects on productivity at the firm level, but Rodrigue and Kasahara (2004) and Blalock and Veloso (2004) found significant but variable (depending on measure-ment methods) effects. Studies on the relationship between exporting and productivity, such as Kraay (1999), Castellani (2001), Bigsten et al. (2002), and Van Biesebroeck (2005), which rely more heavily on firm- or plant-level data, found sig-nificant productivity benefits from exporting. Others, such as Bernard and Jensen (1999), Clerides, Lach, and Tybout (1998), Aw, Chung, and Roberts (2000), and Delgado, Fariñas, and Ru-ano (2002), suggested that estimated correlations are instead due to self-selection of higher productivity plants into export markets. Studies of FDI impacts on productivity, including

Caves (1974), Globerman (1979), Blomström (1986), Blom-ström and Wolff (1989), Haddad and Harrison (1993), Doms and Jensen (1998), and Aitken and Harrison (1999), found that both industries and firms/plants with higher foreign shares are more productive, and Helpman, Melitz, and Yeaple (2004) showed that FDI effects dominate export effects.

Such studies typically estimate a single technology transfer effect by including a variable reflecting the existence of foreign linkages (say, a dummy variable for importing) in an equation representing the production technology, and interpreting the es-timated coefficient as the associated productivity effect. This implicitly assumes homogeneity across the distribution of ex-planatory variables and assumes rather than establishes causa-tion. In particular, it raises issues about representing the coun-terfactual of a plant not transferring technology when it is ob-served to do so, if such decisions are associated with other productivity determinants. That is, the resulting estimates may confound productivity differences arising from foreign technol-ogy transfer with those from other factors affecting technoltechnol-ogy transfer decisions.

We address this causality issue in the context of examin-ing relationships between productivity and the three primary technology transfer channels identified in the literature (im-ports, ex(im-ports, and FDI) for Turkish manufacturing plants. To accomplish this we use nonparametric propensity score match-ing methods that directly compare the productivity of plants with different technology transfer reliance but otherwise similar characteristics. This approach, similarly to the matching tech-niques used by Wagner (2002), Girma, Greenaway, and Kneller (2003), and De Loecker (2004), allows us explicitly to repre-sent the counterfactual of a plant not transferring technology to determine causal inference.

More specifically, these methods collapse a vector of plant characteristics to a “score” representing the plant’s propen-sity to transfer technology (Rosenbaum and Rubin 1983).

© 2008 American Statistical Association Journal of Business & Economic Statistics January 2008, Vol. 26, No. 1 DOI 10.1198/073500107000000197

105

106 Journal of Business & Economic Statistics, January 2008

Based on these scores, we alternatively match plants using “nearest-neighbor” and “kernel” techniques that impose differ-ent weighting schemes to iddiffer-entify a comparison plant. This en-sures that plants matched to compare productivity effects have the same distribution of characteristics independently of their choice to transfer technology, so the choice is statistically ran-dom and the estimates unbiased with respect to self-selection.

Matching techniques have been applied extensively in labor economics to examine “treatment effects” in the presence of selection bias, which occurs when characteristics of program participants differ from nonparticipants (Rosenbaum and Rubin 1983; Rosenbaum 1984; Heckman 1997; Heckman, Ichimura, and Todd 1997; Heckman, Ichmura, Smith, and Todd 1998; Heckman, Lalonde, and Smith 2000; Angrist 2003). In the terminology of this literature, estimating the effect of “treat-ment” (in our case, technology transfer) requires comparing the observed “performance” (productivity) of a “program partici-pant” (plant that transferred foreign technology) with the per-formance that would have resulted had that participant not been treated (had the plant not transferred any technology).

Our application requires estimates of plant productivity to provide a basis for comparison, which if estimated parametri-cally may also suffer from endogeneity bias. We thus use and compare alternative nonparametric and parametric methods to measure productivity. Our nonparametric measures include la-bor and total factor productivity (TFP) indexes, estimated as output per labor unit and a multilateral index of output per unit of aggregate inputs, respectively. Our parametric production functionTFPmeasure is estimated by a method that controls for possible simultaneity and selection biases.

We find that plants that participate in the export market, have foreign ownership, and import materials and capital, have higher total factor and labor productivity. Our results confirm the positive productivity impacts of foreign technology trans-fer through these channels, and the relative dominance of FDI to exporting (with importing less significant), suggested by the literature and by alternative methods applied to similar data. They also, however, establish causal inference by explicitly for-mulating the counterfactual as the productivity level the plant would have had without foreign technology transfer. Because productivity levels of internationally linked plants are on aver-age higher than those of domestic plants even after matching, our results show that transferring foreign technology enhances plant productivity irrespective of other measurable plant char-acteristics.

2. THE EMPIRICAL APPROACH

2.1 Treatment Effects

Consider as an example the case of importing (IMP); analo-gous measures can be defined for exporting (EXP) and foreign ownership (FDI). LetIMPit ∈ {0,1} be a variable indicating

whether plant i imported any machines, equipment, and ma-terial at timet. Further, let τiI1 denote the value of the plant’s productivity (τ) for plants that purchased foreign technology (I1 denotesIMP=1) and letτiI0denote the same plant’s pro-ductivity level had it not imported any technology (I0 denotes

IMP=0). The productivity effect of importing for planti(the

treatment effect) can then be defined asτiI1−τiI0. The funda-mental problem of causal inference for this effect is thatτiI0is unobservable; a firm cannot be an importer and a nonimporter at the same time (Holland 1986). However, the average effect of treatment (imports) on the treated (importing plants),ATT, can be defined, following Holland (1986) and Heckman et al. (1997), as

ATT=E[τiI1−τiI0|IMPi=1]

=E[τiI1|IMPi=1] −E[τiI0|IMPi=1]. (1)

In addition to measuring the average treatment effects on treated (importing) plants,ATT, we can calculate the average effects for the whole population of treated plants as ATE=

E[τiI1−τiI0] and for the controls (nonimporting plants) as

ATU=E[τiI1−τiI0|IMPi=0]. That is, ATEindicates the

im-pact of treatment on average plant productivity—the average outcome differences between the treated and control plants.

ATUindicates the potential impact on plants that did not trans-fer technology but had a “propensity” to do so—the average dif-ference between the potential productivity of untreated (nonim-porting) plants if theyhad been treated (imported technology) and the productivity outcome that they attained.

Our primary measures of interest are thus the average plant-level productivity effects of importing, exporting, or foreign ownership, as compared to not importing, not exporting, or be-ing a domestic plant, as captured byATT,ATE, andATU mea-sures for each channel. The sample analogs of these meamea-sures are (Abadie, Drukker, Herr, and Imbens 2001)

ATT= 1 Causal inference relies on the representation of counterfactu-als such as the last term of (1)—the productivity level a treated (importing) plant would have had if it was untreated (did not im-port). This is often estimated using the outcomes for untreated plants:E[τiI0|IMPi=0]. However, a productivity deviation

be-tween importers and nonimporters cannot be used to infer that importing technology was its cause, because plants that im-ported could have been more productive prior to importing due to unmeasured factors.

This implies selection bias; firms that transfer technology likely differ somehow from those that do not. To improve causal inference, the goal is thus to estimate the unobserved component—the average outcome in the untreated state. This requires constructing an experiment that essentially “random-izes” the treatment (technology transfer) of plants, such that se-lection of treated plants is uncorrelated with both observable and unobservable characteristics.

When experimental data are used, this problem is handled by randomly assigning individuals into a treatment group that par-ticipates in the program and a control group that does not. This randomization ensures a complete balancing of all relevant ob-servable and unobob-servable characteristics across the treatment and control groups; potential outcomes are independent of treat-ment status (independence). If the treated and controls are iden-tical except for participation in the program, the difference in the outcome variable can be considered solely attributable to the program (Lalonde 1986).

However, with nonexperimental data for which there is no randomized control group, the goal is to find controls that are as similar to the treated as possible, by using matching estima-tors to approximate the counterfactual outcome (Blundell and Costa Dias 2000). Specifically, the use of matching to construct a valid control group is based on the identifying assumption that, conditional on all relevant observable covariates Z, the

potential outcomes are independent of treatment (conditional independence) so treatment status is random. (See Dehejia and Wahba 2002; Smith and Todd 2005, for discussions about the replication of experimental results by propensity score match-ing.)

2.2 Propensity Scores and Matching Methods

Matching on the basis of n characteristics may be infeasi-ble particularly ifnis large, so methods have been proposed to summarize characteristics into a scalar variable or “propensity score” (Rosenbaum and Rubin 1983; Meyer 1995; Smith 2000; Sianesi 2001). The propensity score was defined by Rosen-baum and Rubin (1983) as the conditional probability of re-ceiving treatment (transferring technology) given pretreatment (no technology transfer) characteristics:

pi(Zi)≡Pr{Di=1/Zi} =E(Di/Zi}, (2)

whereDi= {0,1}is the indicator of “exposure to treatment”

IMPi,FDIi, orEXPiandZiis the vector of theith plant’s

char-acteristics on which the match is made.

We compute the propensity scorespi(Zi)from probit

regres-sions of binary variables indicating whether a plant transferred technology through a given channel in timeton observed plant characteristics in timet−1. The plant characteristics included as explanatory variables(Z)are the logarithms of capital inten-sity (lnKI), wages (lnW), and number of workers (lnL); and the shares of foreign ownership (FDIS), exports (relative to to-tal output,EXPS), imports (of machines and equipment relative to total investment,IMPS), administrative and technical work-ers (in total labor,AWSandTWS), and subcontracted inputs and outputs (input subcontracted to supplier plants,SCI, and out-put subcontracted by other plants,SCO). We also include year, industry, and regional dummy variables.

Deriving ourATT,ATE, andATUmeasures frompi(Zi)

re-quires the matching of plants to be “balanced,” which is sat-isfied if plants with the same propensity score have the same distribution of observed covariates independently of treatment status (Becker and Ichino 2002). This property must therefore be satisfied by the probability model chosen to estimate the propensity score, E(D/Zi)=F(h(Zi)), where F(·) is the cu-mulative distribution andh(Zi)is a function of covariates with

linear and higher order terms. We confirm that our choice of lin-ear and higher order terms for estimation verifies the balancing property using an iterative process developed by Leuven and Sianesi (2003).

The quality of the matches used to estimateATT,ATE, and

ATUis improved by matching only plants that fall in the “com-mon support,” defined as those whose “propensity score be-longs to the intersection of the supports of the propensity score of treated and controls” (Becker and Ichino 2002). In our case some plants that transfer technology have no comparable plants, so estimates without common support may capture the effects of both treatment and pretreatment variables. We eliminate this bias by dropping treated plant observations with propensity scores higher than the maximum or lower than the minimum of the controls.

Even after verifying the balancing property and including only the treated plants that fall in the common support, however, it is unlikely to find plants that transfer and do not transfer tech-nology with exactly the same propensity score. To overcome this difficulty, we alternatively use nearest-neighbor (NN) and kernel techniques to match the plants.

With the nearest-neighbor matching technique, for each treated plant one untreated plant with the closest propensity score is selected. That is, this method assigns a weight of 1 to 7 for the nearest comparison unit in terms of the propensity score, and zero to all other observations. We implement this technique with replacement because a treated plant can be a best match for more than one nontreated plant. However, for some treated plants the nearest neighbor (matched control) may have a very different propensity score. Because this match con-tributes equally to the estimation of the treatment effect with other plants with a much closer match, the overall results may be biased (Becker and Ichino 2002).

With kernel matching, by contrast, treated plants are matched with a weighted average of all untreated plants, using weights that are inversely proportional to the distance between the propensity scores of treated and controls. Formally, the weight-ing function is a (Gaussian) kernel density. A large weight is thus given to close matches and a small one to poor matches.

2.3 Productivity Measures

Estimating productivity differences between matched plants that do and do not transfer foreign technology also requires rel-evant measures of productivity. Labor productivity (LP) is typ-ically defined as output (Y) per unit of labor input(L),Y/L, or in log-form as lnLP=lnY−lnL. This measure can be com-puted directly from data onYandL, but does not accommodate input substitution (such as differing capital intensities). Total factor productivity (TFP) is similarly defined as output per unit of aggregate input(X),Y/X, or lnTFP=lnY−lnX. However, computing such a measure requires some method of aggregat-ing inputs into the measureX.

One approach is to use the multilateral index function of Good, Nadiri, and Sickles (1996), implemented by Aw et al. (2000). For this measure, hypothetical plant reference points are constructed for each cross-section and linked together over

108 Journal of Business & Economic Statistics, January 2008

time. Specifically, for plantj, producing outputYjtusingiinputs

Xijt with cost sharesSijt:

where lnYt and lnXit are the natural logs of the geometric

means of output and the inputs across all plants in time period

t, andk=2,3, . . . ,t.

The terms in the first parentheses measure the plant’s out-put relative to the representative plant in yeart, allowing com-parisons among cross-sections. The second terms reflect the change in the representative plant’s output across all years, while chaining the representative plant values to the base year and allowing comparisons over time. The next terms provide analogous information for inputs, using cost shares as weights. The resulting measure is theTFPof plantjin yeartrelative to the representative plant in the base year.

TFPmay alternatively be computed, as in much of the liter-ature on one-stage estimation of productivity effects, by para-metrically estimating a production function and using the es-timated output elasticities as “shares” to sum the inputs into the aggregate inputX. Specifically, lnTFPjtis often computed

by approximating the weighted sum of the inputs lnX from estimation of the Cobb–Douglas production function lnYjt=

iβilnXijt, so lnTFP=lnYjt−iβilnXijt. However, such

estimates may suffer from simultaneity and self-selection prob-lems even if foreign technology transfer effects are not esti-mated directly within the production function. We therefore es-timate lnTFPjtusing the semiparametric approach of Olley and

Pakes (1996) that controls for such biases (TFPOP).

The Olley–Pakes (OP) approach assumes that plants’ deci-sions about remaining in the market and investing in capital depend on expected profitability (whether the plant’s liquida-tion value exceeds expected discounted returns), which in turn is a function of current productivity (with productivity shocks that follow a first-order Markov process) and capital levels. The error term for the production function thus includes both a ran-dom error and a productivity residual or shock, which becomes a state variable in the plant’s decision-making process. Estima-tion then involves including an investment decision funcEstima-tion (approximated by a second-order polynomial in capital stock and investment) into the production function to accommodate simultaneity, and computing survival probabilities (from a pro-bit model based on a polynomial series in investment and capi-tal stock) to control for selection bias.

3. THE DATA AND RESULTS

Our data were collected by the Turkish State Institute of Sta-tistics, from the Annual Surveys of Manufacturing Industries, and are classified according to the International Standard Indus-trial Classification (ISIC Rev. 2). For estimation of our model

we use unbalanced panel data on plants with more than 25 em-ployees for the apparel (ISIC 3222), textile (ISIC 3212), and motor vehicle and parts (ISIC 3843) industries for 1990–1996.

ISIC 3222 and ISIC 3212 are the primary subsectors of the textile, wearing apparel, and leather industry (ISIC 32), which accounts for approximately 35%, 20%, 23%, and 48% of to-tal Turkish manufacturing employment, output, wages, and ex-ports, respectively.ISIC 3843accounts for about 5%, 10%, 7%, and 5% of total Turkish manufacturing employment, output, and exports.

Our plant-level data document for each year whether the plant falls in the export status category (EXP) and the value of exports; whether the plant imported any machinery/equipment and materials (IMP) and the value of that investment; and whether the plant has any foreign ownership (FDI) and its share. The sharesFDIS,EXPS, andIMPScomputed from these data, as well as information on capital intensity (KI), the num-ber of workers and their wage(L,W), labor shares of admin-istrative and technical workers (AWS,TWS), and subcontracted input and output shares (SCI,SCO), are used in the probit re-gressions defining the propensity scores for matching. The data also provide information on levels of output(Y), capital(K), labor hours(L), energy(E), and material inputs(M), which we use for the computation of the productivity variables. Summary statistics of the data are reported in Table A1 in the Appendix.

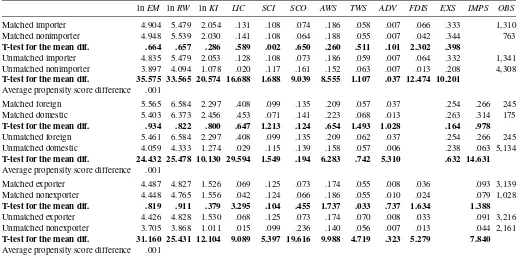

Before focusing on the productivity impacts of importing, exporting, and FDI for the Turkish manufacturing plants in our data, it is informative to assess the validity of the match-ing for the treated and nontreated plants. Although it is diffi-cult directly to test conditional independence, it can be evalu-ated by considering the distribution of covariates between the groups of plants. For this purpose, Table 1 reports average lev-els of the (lagged) variables used in the probit regressions, for the matched and unmatched samples of treated and untreated plants and all three technology transfer channels, based on the NN matching method.

These results validate the matching procedure because they show no significant differences between the groups. For ex-ample, the difference in the mean (logarithm of) capital inten-sity between importers and nonimporters is .024 after match-ing (average lnKI is 2.054 and 2.030 for the importers and nonimporters). This difference is .975 (2.053 −1.078) for the unmatched sample. The difference in means between im-porters and nonimim-porters is also significant before matching (t=20.574) but insignificant after matching (t=.286). Com-parisons for other variables and for the foreign/domestic and exporting/nonexporting plants exhibit similarly tight matches. Further, the average propensity score difference between the treated and control groups is very small (.001 for exporting and importing and .008 forFDI). These measures show that the bal-ancing property of the propensity scores is ensured by the com-mon support restriction.

The estimated average treatment effectsATT,ATE, andATU

are presented in Table 2 for the three foreign technology trans-fer methods and both the NN and kernel matching methods, based on our “preferred” OP parametric TFPOP productivity measure that controls for selection on observables and unob-servables. The estimates show that the averageTFPeffect of importing machinery, equipment, and materials for plants that

Table 1. Comparison of treated and control: matched vs. unmatched

lnEM lnRW lnKI LIC SCI SCO AWS TWS ADV FDIS EXS IMPS OBS

Matched importer 4.904 5.479 2.054 .131 .108 .074 .186 .058 .007 .066 .333 1,310 Matched nonimporter 4.948 5.539 2.030 .141 .108 .064 .188 .055 .007 .042 .344 763

T-test for the mean dif. .664 .657 .286 .589 .002 .650 .260 .511 .101 2.302 .398

Unmatched importer 4.835 5.479 2.053 .128 .108 .073 .186 .059 .007 .064 .332 1,341 Unmatched nonimporter 3.897 4.094 1.078 .020 .117 .161 .152 .063 .007 .013 .208 4,308

T-test for the mean dif. 35.575 33.565 20.574 16.688 1.688 9.039 8.555 1.107 .037 12.474 10.201

Average propensity score difference .001

Matched foreign 5.565 6.584 2.297 .408 .099 .135 .209 .057 .037 .254 .266 245 Matched domestic 5.403 6.373 2.456 .453 .071 .141 .223 .068 .013 .263 .314 175

T-test for the mean dif. .934 .822 .800 .647 1.213 .124 .654 1.493 1.028 .164 .978

Unmatched foreign 5.461 6.584 2.297 .408 .099 .135 .209 .062 .037 .254 .266 245 Unmatched domestic 4.059 4.333 1.274 .029 .115 .139 .158 .057 .006 .238 .063 5,134

T-test for the mean dif. 24.432 25.478 10.130 29.594 1.549 .194 6.283 .742 5.310 .632 14.631

Average propensity score difference .001

Matched exporter 4.487 4.827 1.526 .069 .125 .073 .174 .055 .008 .036 .093 3,139 Matched nonexporter 4.448 4.765 1.556 .042 .124 .066 .186 .055 .010 .024 .079 1,028

T-test for the mean dif. .819 .911 .379 3.295 .104 .455 1.737 .033 .737 1.634 1.388

Unmatched exporter 4.426 4.828 1.530 .068 .125 .073 .174 .070 .008 .033 .091 3,216 Unmatched nonexporter 3.705 3.868 1.011 .015 .099 .236 .140 .056 .007 .013 .044 2,161

T-test for the mean dif. 31.160 25.431 12.104 9.089 5.397 19.616 9.988 4.719 .323 5.279 7.840

Average propensity score difference .001

transferred technology through this channel, relative to their productivity had they not been importers (ATT), is positive and statistically significant (at the 1% level); the estimated effects are 7.2% and 5.5% for NN and kernel matching, respectively.

The effect of transferring technology through importing for a randomly chosen plant (ATE) is aTFPincrease of 8.9% or 8.7% for NN or kernel matching. In turn, plants that did not transfer technology through importing (ATU) would have ex-perienced an estimated 9.4% or 9.8% increase inTFPhad they done so. These larger estimates forATEandATUindicate that the productivity enhancement from importing foreign technol-ogy for plants that have not done so would be even greater than

Table 2. AverageATT,ATE, andATUproductivity effects, based onTFPOP

AverageIMP AverageFDI AverageEXP effect effect effect

Nearest ATT .072∗ .213∗ .116∗ neighbor (.027) (.059) (.025) ATE .089∗ .215∗ .112∗ (.032) (.081) (.022) ATU .094∗ .216∗ .106∗ (.038) (.078) (.033)

Kernel ATT .055∗ .201∗ .119∗ (.017) (.040) (.020) ATE .087∗ .287∗ .119∗ (.026) (.060) (.017) ATU .098∗ .291∗ .118∗ (.031) (.063) (.022)

NOTE: The standard errors in parentheses are bootstrapped using 500 replications.

∗Significant at the 1% level.

∗∗Significant at the 5% level.

∗∗∗Significant at the 10% level.

for plants that currently transfer technology through this chan-nel.

This suggests, because matching is effectively accomplished on observables, that unobserved plant characteristics underlie this difference. That is, as noted by Heckman (1997) and Blun-dell, Dearden, and Sianesi (2005),ATUestimates could be up-ward biased due to the more restrictive assumption of no se-lection based on unobservables. Potential reasons for such de-viations in our case could be, for example, limited ability to finance up-front costs associated with international linkages, or presence of skilled labor to take advantage of imported tech-nology, that keep plants from importing materials and capital assets.

The effects ofEXPand especiallyFDIare greater as well as statistically significant (at the 1% level) and more similar across matching methods than those for IMP; the estimatedATT of

FDIfor NN and kernel matching are 21.3% and 20.1% and of

EXPare 11.6% and 11.9%. TheATEandATUeffects are also closer toATT than forIMP(except for the kernel matching for

FDIwhich is somewhat higher at about 29%), suggesting that unobservables have little effect on these estimates.

These estimated productivity impacts may justifiably be in-terpreted as causal effects of technology transfer, given the closeness of the matching exhibited by the measures in Ta-ble 1. That is, because the matching methods explicitly formu-late the counterfactual as the productivity level the plant would have had without any foreign technology transfer through these channels, the estimates establish causal inference. They show that transferring foreign technology enhances plant productiv-ity irrespective of other measured plant characteristics, support-ing the notion that causation works from international linkages to productivity.

Further, we assessed the consequences of controlling for se-lection on observables through matching by comparing these

110 Journal of Business & Economic Statistics, January 2008

results with parametric ATT estimates from ordinary least squares (OLS) regressions ofTFPon each of the foreign tech-nology transfer channels and the variables used for matching. The parametrically estimatedFDI,EXP, andIMPeffects from this exercise, .125, .088, and .45, underestimate the magnitudes of the selection-controlled effects but maintain their relative rankings and statistical significance. Further, we applied instru-mental variables estimating techniques (including static and dy-namic generalized method of moments) in an attempt to control for selection on unobservables. However, available instruments such as lagged values of these variables were weak (based on Sargan tests of their validity), and the resulting estimates thus very close to the OLS estimates.

We also evaluated the robustness of our two-step approach, because if technology transfer is correlated with inputs the re-sulting estimates could be inconsistent and inference from the second step estimates biased. To consider this possibility we ap-plied a one-step procedure that includes the technology transfer measures as arguments of the production function used to esti-mateTFP. Such an experiment, using OP estimation to control for simultaneity and selection and based on the shares ofIMP,

FDI, andEXP (instead of dummy variables, due to the poly-nomial specification), generated similar (but somewhat greater in magnitude) estimates compared to matching. For example, the resulting (statistically significant) estimates were .277, .225, and .068 for the productivity effects ofFDI, exporting, and im-porting, respectively, compared to .201, .119, and .055 forATT

from the kernel matching method.

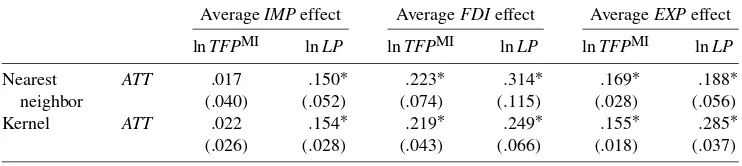

Matching based on nonparametric productivity measures also side-steps possible problems from a two-stage economet-ric approach. In Table 3 we presentATTestimates based on the

LPandTFPMIproductivity measures and both NN and kernel matching. The estimates using labor productivity (LP) are much larger (and significant); the estimated average importing effect is about 15% for both NN and kernel matching, the foreign ownership effect 25–30% (smaller for kernel), and the export-ing effect 19–28% percent (larger for kernel). The greater mag-nitude of these estimates suggests differing impacts for plants with varying capital intensity, because a greater share of capital relative to labor implies higher labor productivity. By contrast, the estimates based onTFPMIare smaller and insignificant for

IMP, comparable forFDI, and slightly larger forEXP. These patterns suggest that the cost weighting of the index number ap-proach internalizes the productive impacts of importing inputs,

Table 4. Correlation coefficients forIMP,EXP, andFDI

IMP EXP FDI

IMP 1.000

EXP .272 1.000

FDI .188 .098 1.000

and that parametric/shadow weights from production function estimation better capture the productive impacts of exporting.

Finally, although our analysis separately considers each tech-nology transfer channel, there could be interactions among these effects; for example, plants that export may also import. This would violate the conditional independence assumption if, conditional on the observables, other treatments predict a par-ticular treatment. As can be seen from Table 4, however, the correlations among exports, imports, andFDIare surprisingly small.

In sum, the estimates from matching methods based on

TFPOP, which most justifiably accommodate causation and se-lection issues, support the suggestion from the literature that the primary plant-level channel through which foreign technology transfer has an impact isFDI, followed by “learning by export-ing.” The results for these and alternative methods also indi-cate positive averageTFPand LP effects of transferring for-eign technology through importing, although they are smaller and their size and significance vary more by specification than theFDI andEXPeffects. These results are also broadly con-sistent with Yasar and Morrison Paul (2007), who used general correlations and a flexible production function model to address questions about economic performance and foreign technology transfer, although they found a significant impact of licensing on overall productivity, which was not evident in preliminary analysis using matching methods.

4. CONCLUDING REMARKS

Recent studies have found that internationally engaged firms or plants are more productive than domestic units in the same industry, even after controlling for size and other observed char-acteristics. What is not well established by the literature, how-ever, is whether these benefitsresultfrom the decision to trans-fer technology by establishing international linkages. That is, further evidence is required to show whether foreign technology transfer actually causes higher total factor or labor productivity of firms or plants.

Table 3. AverageATTproductivity effects, based onTFPMIandLP

AverageIMPeffect AverageFDIeffect AverageEXPeffect

lnTFPMI lnLP lnTFPMI lnLP lnTFPMI lnLP Nearest ATT .017 .150∗ .223∗ .314∗ .169∗ .188∗

neighbor (.040) (.052) (.074) (.115) (.028) (.056) Kernel ATT .022 .154∗ .219∗ .249∗ .155∗ .285∗ (.026) (.028) (.043) (.066) (.018) (.037)

NOTE: The standard errors in parentheses are bootstrapped using 500 replications.

∗Significant at the 1% level.

∗∗Significant at the 5% level.

∗∗∗Significant at the 10% level.

In this article we have provided insights about the causal ef-fects of exporting, importing, andFDIon the productivity of plants in three Turkish manufacturing industries (textiles, ap-parel, and motor vehicles), using propensity score matching techniques that control for selection on observable plant char-acteristics. Our results show that plants that export, import, or have a foreign share are significantly more productive even after matching, and that theFDIeffect is dominant, followed by the export effect. Specifically, total factor productivity is higher by approximately 20%, 12%, and 6% for matched plants that trans-fer foreign technology throughFDI, exporting, and importing. These measures indicate not only that internationally involved plants are more productive than their domestic counterparts, but also that establishing international linkages through these tech-nology transfer channels causes higher productivity.

The foreign technology transfer effects are similar whether one considers the imputed effects for plants that transfer tech-nology (ATT) or the potential gain for plants that did not trans-fer technology (ATE) (although a somewhat largerATEforIMP

suggests that unobservables cause overestimation of the effect for nonimporting plants). Differences across alternative match-ing methods are not substantive, but OLS estimation seems to understate, and one-step methods possibly overstate, the pro-ductivity effects of foreign technology transfer. The estimated impacts are also greater for labor than total factor productivity, and smaller and less significant forIMPwhenTFPis measured nonparametrically.

The implications of our estimates are quite robust to alterna-tive methods used to consider possible biases from simultane-ity, selection (on observables and unobservables), or two-stage estimation. Overall, they indicate that providing incentives for firms to internalize foreign technology through exporting, and particularly foreign ownership, would improve the productivity and thus competitiveness of Turkish manufacturing plants. The results for importing are somewhat more ambiguous, due possi-bly to unobservables that affect the value of imported materials and capital assets for nonimporting plants.

ACKNOWLEDGMENTS

We would like to thank Omer Gebizlioglu, Ilhami Minte-mur, and Emine Kocberber at the State Institute of Statistics in Turkey for allowing us access to the data for this study, and Erol Taymaz for helpful discussions about the data. We also are indebted to the associate editor and two anonymous referees for their constructive and useful suggestions.

[Received June 2005. Revised October 2006.]

REFERENCES

Abadie, A., Drukker, D., Herr, J. L., and Imbens, G. (2001), “Implementing Matching Estimators for Average Treatment Effects in Stata,”Stata Journal, 1, 1–18.

Aitken, B., and Harrison, A. (1999), “Do Domestic Firms Benefit From Foreign Direct Investment? Evidence From Venezuela,”American Economic Review, 89, 605–618.

Angrist, J. (2003), “Treatment Effect Heterogeneity in Theory and Practice,” Discussion Paper 851, IZA (Institute for the Future of Labor), Bonn, Ger-many.

APPENDIX

Table A1. Summary statistics (constant value quantities at 1987 prices, in ‘000 Turkish Lira)

Continuous Standard

variables Mean deviation Minimum Maximum

Output(Y) 5,404.46 34,398.31 3.65 1,212,264.00 Dummy variables and shares for dummy variables)

Import dummy (IMP) 23.19

FDI dummy (FDI) 4.44

Export dummy (EXP) 57.41

Import share (IMPS) 20.33

FDI share (FDIS) 2.43

Export share (EXS) 22.48

Log of number of workers (lnEM) 4.12

Log of wages (lnRW) 4.40

Log of capital intensity (lnKI) 1.28 Subcontracted input (SCI) 11.33 Subcontracted output (SCO) 14.32 Administrative share (AWS) 15.98

Technical share (TWS) 2.90

Textile industry 9.77

Apparel industry 68.72

Motor vehicles and parts industry 21.51

Small 50.02

Medium 21.55

Large 28.43

Agean region 20.10

Black Sea region 1.11

Central Anatolian region 5.72

Eastern and South-East 1.11

Anatolian region

Marmara region 69.48

Mediterranean region 2.51

Observations 7,025

Aw, B., Chung, S., and Roberts, M. (2000), “Productivity and Turnover in the Export Market: Micro Evidence From Taiwan and South Korea,”World Bank Economic Review, 14, 65–90

Becker, S. O., and Ichino, A. (2002), “Estimation of Average Treatment Effects Based on Propensity Scores,”Stata Journal, 2, 358–377.

Bernard, A., and Jensen, J. B. (1999), “Exceptional Exporters Performance: Cause, Effect or Both?”Journal of International Economics, 47, 1–25. Bigsten, A., Collier, P., Dercon, S., Fafchamps, M., Gauthier, B., Gunning, J.

W., Habarurema, J., Oduro, A., Oostendorp, R., Pattillo, C., Soderbom, M., Teal, F., and Zeufack, A. (2002), “Do African Manufacturing Firms Learn From Exporting?”Journal of Development Studies, 40, 115–141.

Blalock, G., and Veloso, F. (2004), “Trade, Technology Transfer and Productiv-ity Growth: The Neglected Role of Imports,” unpublished manuscript, Cor-nell University.

Blomström, M. (1986), “Foreign Investment and Productive Efficiency: The Case of Mexico,”Journal of Industrial Economics, 15, 97–110.

Blomström, M., and Wolff, E. N. (1989), “Multinational Corporations and Pro-ductivity Convergence in Mexico,” working paper, National Bureau of Eco-nomic Research, Cambridge, MA.

Blundell, R., and Costa Dias, M. (2000), “Evaluation Methods for Non-Experimental Data,”Fiscal Studies, 21, 427–468.

112 Journal of Business & Economic Statistics, January 2008

Blundell, R., Dearden, L., and Sianesi, B. (2005), “Evaluating the Effect of Ed-ucation on Earnings: Models, Methods and Results From the National Child Development Survey,”Journal of the Royal Statistical Society, Ser. A, 168, 473–512.

Castellani, D. (2001), “Export Behavior and Productivity Growth: Evidence From Italian Manufacturing Firms,” mimeo, ISE-Università di Urbino. Caves, R. E. (1974), “Multinational Firms, Competition and Productivity in

Host Country Markets,”Economica, 41, 176–193.

Clerides, S., Lach, S., and Tybout, J. (1998), “Is Learning by Exporting Im-portant? Microdynamic Evidence From Columbia, Mexico and Morocco,” Quarterly Journal of Economics, 113, 903–948.

Coe, D. T., and Helpman, E. (1995), “International R&D Spillovers,”European Economic Review, 39, 859–887.

De Loecker, J. (2004), “Do Exports Generate Higher Productivity? Evidence From Slovenia,” LICOS Discussion Paper 15104, Katholieke Universiteit Leuven.

Dehejia, R. H., and Wahba, S. (2002), “Propensity Score Matching Methods for Non-Experimental Causal Studies,”Review of Economics and Statistics, 84, 151–161.

Delgado, M., Fariñas, J., and Ruano, S. (2002), “Firm Productivity and Export Markets: A Non-Parametric Approach,”Journal of International Economics, 57, 397–422.

Doms, M., and Jensen, J. B. (1998), “Comparing Wages, Skills, and Produc-tivity Between Domestically and Foreign-Owned Manufacturing Establish-ments in the United States,” inGeography and Ownership as Bases for Eco-nomic Accounting, eds. R. Baldwin, R. Lipsey, and D. Richardson, Chicago: Chicago University Press, pp. 235–258.

Eaton, J., and Kortum, S. (1996), “Trade in Ideas: Patenting and Productivity in the OECD,”Journal of International Economics, 40, 251–278.

Girma, S., Greenaway, D., and Kneller, R. (2003), “Export Market Exit and Per-formance Dynamics: A Causality Analysis of Matched Firms,”Economics Letters, 80, 181–187.

Globerman, S. (1979), “Foreign Direct Investment and Spillover Efficiency Benefits in Canadian Manufacturing Industries,”Canadian Journal of Eco-nomics, 12, 42–56.

Good, D., Nadiri, I., and Sickles, R. (1996), “Index Number and Factor De-mand Approaches to the Estimation of Productivity,” Working Paper 5790, National Bureau of Economic Research, Cambridge, MA.

Haddad, M., and Harrison, A. (1993), “Are There Positive Spillovers From Di-rect Foreign Investment? Evidence From Panel Data for Morocco,”Journal of Development Economics, 42, 51–74.

Heckman, J. J. (1997), “Instrumental Variables: A Study of Implicit Behavioral Assumptions Used in Making Program Evaluations,”Journal of Human Re-sources, 32, 441–462.

Heckman, J. J., Ichimura, H., and Todd, P. (1997), “Matching as an Econo-metric Evaluation Estimator: Evidence From Evaluating a Job Training Pro-gramme,”Review of Economic Studies, 64, 605–654.

Heckman, J. J., Ichimura, H., Smith, J., and Todd, P. (1998), “Characterizing Selection Bias Using Experimental Data,”Econometrica, 66, 1017–1098. Heckman, J. J., Lalonde, R. J., and Smith, J. A. (2000), “The Economics and

Econometrics of Active Labor Market Programs,” inHandbook of Labor Economics, Vol. III, eds. O. Ashenfelter and D. Card, Amsterdam: North Holland, pp. 1865–2097.

Helpman, E., Melitz, M. J., and Yeaple, S. R. (2004), “Export versus FDI With Heterogeneous Firms,”American Economic Review, 94, 300–316. Holland, P. (1986), “Statistics and Causal Reasoning,”Journal of the American

Statistical Association, 81, 945–960.

Keller, W. (2002a), “Geographic Localization of International Technology Dif-fusion,”American Economic Review, 92, 120–142.

(2002b), “Knowledge Spillovers at the World’s Technology Frontier,” working paper, University of Texas, Austin, Dept. of Economics.

Keller, W., and Yeaple, S. R. (2003), “Multinational Enterprises, International Trade, and Productivity Growth: A Firm Level Evidence From the United States,” working paper, University of Texas, Austin, Dept. of Economics. Kraay, A. (1999), “Exports and Economic Performance: Evidence From a Panel

of Chinese Enterprises,”Revue d’Economie du Developpement, 183–207. Kraay, A., Soloaga, I., and Tybout, J. (2001), “Product Quality; Productive

Effi-ciency and International Technology Diffusion: Evidence From Plant-Level Panel Data,” Policy Research Working Papers 2759, World Bank.

Lalonde, R. (1986), “Evaluating the Econometric Evaluations of Training Pro-grams,”American Economic Review, 76, 604–620.

Leuven, E., and Sianesi, B. (2003), “PSMATCH2: STATA Module to Perform Full Mahalanobis and Propensity Score Matching, Common Support Graph-ing, and Covariate Imbalance TestGraph-ing,” available athttp://ideas.repec.org/ c/boc/bocode/s432001.html. Version 1.2.3.

Meyer, B. D. (1995), “Natural and Quasi-Experiments in Economics,”Journal of Business & Economic Statistics, 13, 151–162.

Olley, S., and Pakes, A. (1996), “The Dynamics of Productivity in the Telecom-munications Equipment Industry,”Econometrica, 64, 1263–1298.

Rodrigue, J., and Kasahara, H. (2004), “Does the Use of Imported Intermediates Increase Productivity? Plant-Level Evidence,” presented at the Econometric Society North American Summer Meetings.

Rosenbaum, P. (1984), “From Association to Causation in Observational Stud-ies: The Role of Tests of Strongly Ignorable Treatment Assignment,”Journal of the American Statistical Association, 79, 41–48.

Rosenbaum, P., and Rubin, D. B. (1983), “The Central Role of the Propensity Score in Observational Studies for Causal Effects,”Biometrika, 70, 41–55. Sianesi, B. (2001), “Implementing Propensity Score Matching Estimators With

Stata,” presented at the VII Meeting of UK Stata Users Group, London. Smith, J. (2000), “A Critical Survey of Empirical Methods for Evaluating

Ac-tive Labor Market Policies,”Swiss Journal of Economics and Statistics, 136, 247–268.

Smith, J., and Todd, P. (2005), “Does Matching Address Lalonde’s Critique of Nonexperimental Estimators,”Journal of Econometrics, 125, 305–353. Van Biesebroeck, J. (2005), “Exporting Raises Productivity in Sub-Saharan

African Manufacturing Firms,”Journal of International Economics, 67, 373–391.

Wagner, J. (2002), “The Causal Effects of Exports on Firm Size and Labor Pro-ductivity: First Evidence From a Matching Approach,”Economics Letters, 77, 287–292.

Xu, B., and Wang, J. (1999), “Capital Goods Trade and R&D Spillovers in the OECD,”Canadian Journal of Economics, 32, 1258–1274.

Yasar, M., and Morrison Paul, C. J. (2007), “International Linkages and Pro-ductivity at the Plant Level: Foreign Direct Investment, Exports, Imports, and Licensing,”Journal of International Economics, 71, 373–388.