Refer to Important disclosures in the last page of this report

StockDataTarget price (Rp) Rp42,500

Prior TP (Rp) Rp43,800

Shareprice (Rp) Rp43,950

Upside/downside (%) (3.3)

Sharesoutstanding (m) 7,630

Marketcap. (US$ m) 22,028

Unilever Indonesia Holding 85.0%

Estimate Change; Vs. Consensus 2018F 2019F PT Indo Premier Sekuritas [email protected] +62 21 5793 1169

Lackluster 3Q18 result

Sluggish top line growth, falling below expectation.

Outstanding bottom line on the back of sale of spreads business.

Margin pressure still persists.

Maintain Hold on UNVR with lower TP of Rp42,500.

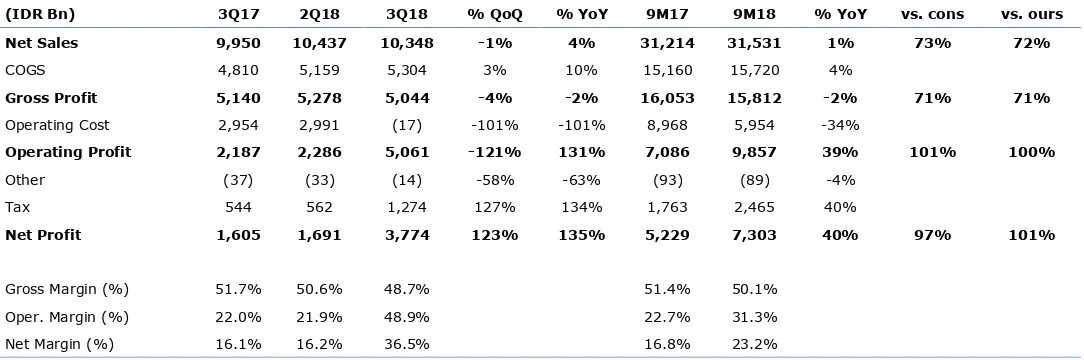

Sluggish top line growth, below expectation.

UNVR recorded net sales of

Rp10.3tn in 3Q18 (+4% yoy; -1% qoq) and Rp31.5tn cumulatively in 9M18 (+1%

yoy), forming 73% of consensus and 72% of ours. Home and personal care (HPC)

segment contributed a significant growth at +6% yoy in 3Q18, while food and

refreshment (FR) declined -0.6% yoy during the same period. On the contrary,

the company’s bottom line grew significantly recording Rp3.8tn in 3Q18 (+135%

yoy; +123% qoq) and Rp7.3tn in 9M18 (+40% yoy), forming 97% of consensus

and 101% of ours. This improvement in net profit can be contributed to the sale

of their spreads segment, which was realized in 3Q18. We remain cautious on

UNVR following the company’s muted growth and declining margin.

Sale of spread business boosted bottom line.

At the end of 2017, Unilever

decided to sell their Spreads segment to KKR, including brands such as Blue Band,

ProActiv and Country Crock. This transaction was only realized in 3Q18, which

was recorded at Rp2.7tn as other income. As a result of this sale, the company’s

operating income and net profit jumped to Rp9.9tn (+39% yoy) and Rp7.3tn

(+40% yoy) respectively in 9M18. However, this is only a one-off gain and will

not be sustainable for the company going forward. If we take out the gain from

the spreads segment sales, operating profit actually declined by -1% yoy in 9M18.

Margin Pressure still persists.

With the further strengthening of the USD and

rising oil price, the company’s margins are put under more pressure. Gross

margin in 3Q18, dropped considerably by 190bps yoy in 3Q18 to only 48.7% (vs.

2Q18: 50.6%; 3Q17: 51.7%), the lowest since 3Q14. Looking into the segments

more closely, both HPC and FR gross margin dropped to 51.1% (320bps yoy;

-140bps qoq) and 43.1% (-270bps yoy; 380bps qoq) respectively in 3Q18. On a

more positive note, marketing and selling expenses continues to drop in 3Q18 by

-7.7% yoy (-4% qoq), slightly dampening the drop in margin.

Valuation.

We slightly trimmed down our revenue forecast by 2.0%/1.5%

following the company’s lackluster growth in 9M18. However, we raise our net

profit forecast by 27% for FY18F taking into account the one-off gain from their

spread segment. Despite our cautious stance, we are still seeing an upside

potential from their personal-care segment, in particular the Hijab products. We

rollover our valuation to FY19F, maintaining our HOLD on the company with a

lower TP of Rp42,500 (based on target P/E of 43x). We transfer coverage from

Putri Tobing to Elbert Setiadharma.

Unilever Indonesia

(

UNVR.IJ

)

30 October 2018

Source : UNVR, IndoPremier Share Price Closing as of : 29-October-2018

2

Refer to Important disclosures in the last page of this report

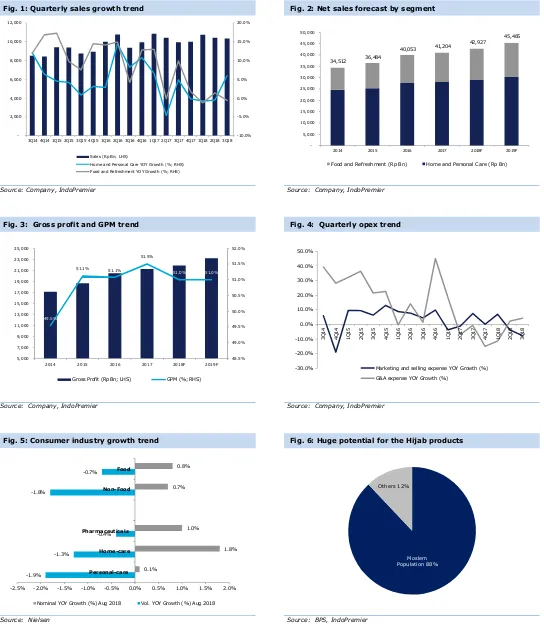

Fig. 1: Quarterly sales growth trend Fig. 2: Net sales forecast by segment

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 3: Gross profit and GPM trend Fig. 4: Quarterly opex trend

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 5: Consumer industry growth trend Fig. 6: Huge potential for the Hijab products

Source: Nielsen Source: BPS, IndoPremier

-10.0%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 Sales (Rp Bn; LHS)

Home and Personal Care YOY Growth (%; RHS) Food and Refreshment YOY Growth (%; RHS)

34,512 36,484

2014 2015 2016 2017 2018F 2019F

Food and Refreshment (Rp Bn) Home and Personal Care (Rp Bn)

49.5%

2014 2015 2016 2017 2018F 2019F

Gross Profit (Rp Bn; LHS) GPM (%; RHS)

-30.0%

Marketing and selling expense YOY Growth (%) G&A expense YOY Growth (%)

-1.9%

Nominal YOY Growth (%) Aug 2018 Vol. YOY Growth (%) Aug 2018

Moslem Population 88%

3

Refer to Important disclosures in the last page of this report

Fig. 7: Earnings Revision

Source: Company, IndoPremier

Fig. 8: Results Summary

(IDR Bn) 3Q17 2Q18 3Q18 % QoQ % YoY 9M17 9M18 % YoY vs. cons vs. ours

4

Refer to Important disclosures in the last page of this report

Year To 31 Dec (RpBn) 2016A 2017A 2018F 2019F 2020F

Income Statement

Net Revenue 40,054 41,205 42,927 45,465 48,600

Cost of Sales (19,595) (19,985) (21,045) (22,274) (23,867)

Gross Profit 20,459 21,220 21,882 23,191 24,733

SG&A Expenses (11,752) (11,715) (12,239) (12,971) (13,993)

Operating Profit 8,707 9,505 9,643 10,220 10,740

Cash & Equivalent 374 405 2,567 392 591

Receivable 3,810 4,855 3,902 4,133 4,418

Inventory 2,318 2,394 2,338 2,475 2,652

Other Current Assets 86 288 293 300 308

Total Current Assets 6,588 7,942 9,101 7,300 7,970

Fixed Assets - Net 9,529 10,422 11,233 11,968 12,329

Goodwill 472 453 431 410 389

Non Current Assets 156 90 90 90 90

Total Assets 16,746 18,906 20,855 19,768 20,777

ST Loans 2,393 3,450 3,000 2,800 2,500

Payable 4,642 4,527 0 5,303 5,683

Other Payables 3,843 4,555 4,036 4,272 4,577

Current Portion of LT Loans 0 0 0 0 0

Total Current Liab. 10,878 12,532 12,047 12,375 12,760

Long Term Loans 0 0 0 0 0

Other LT Liab. 1,163 1,201 1,201 1,201 1,201

Total Liabilities 12,041 13,733 13,248 13,576 13,961

Equity 172 172 172 172 172

Retained Earnings 4,532 5,001 7,435 6,020 6,644

Minority Interest 0 0 0 0 0

Total SHE + Minority Int. 4,704 5,173 7,607 6,192 6,817

Total Liabilities & Equity 16,746 18,906 20,855 19,768 20,777

5

Refer to Important disclosures in the last page of this report

Year to 31 Dec 2016A 2017A 2018F 2019F 2020F

Cash Flow

Net Income (Excl.Extraordinary&Min.Int) 6,391 7,005 9,228 7,536 7,935

Depr. & Amortization 498 496 689 764 839

Changes in Working Capital 189 (887) 1,117 56 88

Others 587 (227) 313 (15) 220

Cash Flow From Operating 7,665 6,387 11,347 8,343 9,082

Capital Expenditure (1,548) (1,304) (1,479) (1,479) (1,179)

Others 7 4 10 10 10

Cash Flow From Investing (1,541) (1,300) (1,469) (1,469) (1,169)

Loans 693 1,057 (450) (200) (300)

Equity 0 0 0 0 0

Dividends (5,843) (6,494) (6,794) (8,951) (7,310)

Others 245 (90) (161) (145) (133)

Cash Flow From Financing (4,905) (5,527) (7,406) (9,296) (7,743)

Changes in Cash 1,219 (440) 2,473 (2,422) 171

FinancialRatios

Gross Margin (%) 51.1 51.5 51.0 51.0 50.9

Operating Margin (%) 21.7 23.1 22.5 22.5 22.1

Pre-Tax Margin (%) 21.4 22.7 28.7 22.2 21.8

Net Margin (%) 16.0 17.0 21.5 16.6 16.3

ROA (%) 39.4 39.3 46.4 37.1 39.1

ROE (%) 134.1 141.8 144.4 109.2 122.0

ROIC (%) 93.9 89.2 96.1 77.0 86.8

Acct. Receivables TO (days) 33.8 38.4 37.2 32.3 32.1

Acct. Receivables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Inventory TO (days) 8.5 8.5 8.9 9.3 9.3

Payable TO (days) 88.3 83.7 82.7 84.5 84.0

Acct. Payables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Debt to Equity (%) 50.9 66.7 39.4 45.2 36.7

Interest Coverage Ratio (x) 0.0 0.0 0.0 0.0 0.0

Net Gearing (%) 42.9 58.9 5.7 38.9 28.0

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period HOLD : Expected total return between -10% and 10% within a 12-month period SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analysts personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS