Directory UMM :Journals:Journal Of Public Economics:Vol78.Issue1-2.Oct2000:

Teks penuh

Gambar

Dokumen terkait

Whether capital income should be taxed or subsidized depends on the correlation between individual savings and consumption and not on the overall level of savings or the

By using panel data that combine regional, sectoral and time variation in unemployment rates and old age labor force participation, they show that the decline in the average

Indeed, reducing marginal tax rates is the most effective way to raise labor supply (in terms of hours), while increasing income differentials between low-skilled workers and

Sobrado, Effect of high external N aCl concentra- tion on the osmolality of xylem sap, leaf tissue and leaf glands secretion of the mangrove A 6 icennia germinans. (L.), F lora

An important category of production control approaches for job shop production is based on workload control (WLC) principles. The WLC con- cepts bu ! er the shop # oor against

Let us de " ne the QUEUE as the total amount of processing work for all of the jobs currently waiting at the work centre this period and let INPUT be the total processing work

The economic literature on the measurement of the value of patents takes as an assumption that the value of any patent is reflected in the number of times the patent is cited, or

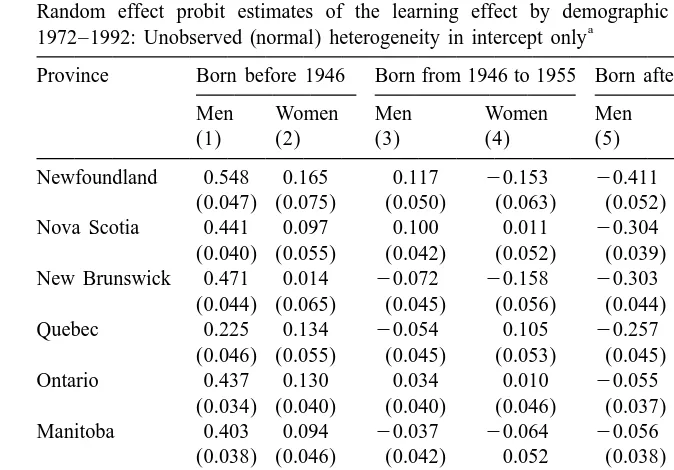

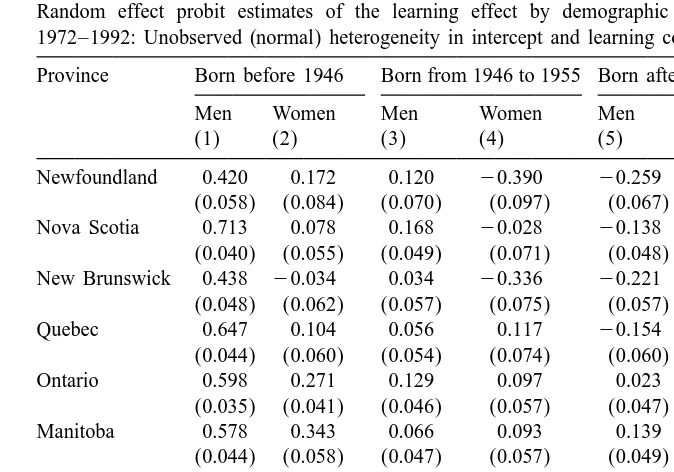

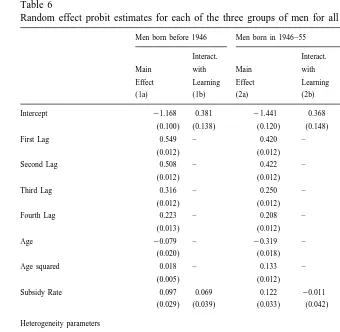

Third, once one deploys a flexible specification for the duration dis- tribution, the use of a mixing distribution to account for unobserved heterogeneity does not appear to