Refer to Important disclosures on the last of this report

Stock DataTarget price (Rp) Rp4,000

Prior TP (Rp) Rp4,100

Shareprice (Rp) Rp3,720

Upside/downside (%) +7.5

Sharesoutstanding (m) 99,062

Marketcap. (US$ m) 25,364

Republic of Indonesia 52.1%

Bank of New York Mellon 6.1%

Public 41.8%

Estimate Change; Vs. Consensus 18F 19F

PT Indo Premier Sekuritas [email protected] +62 21 5793 1168

Recovery mostly priced-in

Post-SIM-card-registration recovery mostly priced in.

More uncertainty in Telkomsel’s long-term growth in outer Java

TLKM group’s EBITDA growth might remain moderate

Reduce TP to Rp4,000 (6% premium to +1STD) – Downgrade to Hold

We expect Telkomsel’s growth to slow.

We believe uncertainty in Telkomsel

(Tsel)’s long-term growth outlook in outer Java has increased as Indosat,

accelerating forecast its capex spending in 4G network coverage (ISAT’s target

18F 4G coverage in outer Java at 60% vs. 2Q18 27%) and is looking for ways to

fund aggressive capex in 19F-21F. Although we expect Tsel would remain as

market leader, but its declining competitive advantage in network coverage vs.

peers in outer Java (XL already improve its outer Java’s network earlier than

Indosat) might affect the effectiveness of Telkomsel’s cluster pricing strategy.

Thus, we slightly reduced TLKM’s EBITDA by 2-4% in 22F-28F.

Modest EBITDA growth.

We forecast moderate YoY growth in TLKM’s revenue

and EBITDA growth of +9%YoY and +6%YoY, respectively in 2019F (vs.

+4/-7%YoY in 2018F) due to: 1) Gradual decline in voice and SMS revenue; 2) Margin

pressure from growing data business; 3) More limited pricing increase opportunity

as more players expand 4G network coverage in outer Java.

Limited contribution from fixed broadband.

We still view TLKM’s fixed

broadband business (Indihome) as positive factor for TLKM, considering its market

growth potential, its management and operational readiness to fulfill demand, and

gradually increasing margin. However, we see limitation from Indihome’s strong

growth impact to TLKM Group in near-term as we estimate Indihome’s revenue

contribution at 9-11% in 18F/19F.

Slightly decrease TP by 3% to Rp4,000 - Downgrade to Hold.

Our

DCF-based TP assume WACC of 10.2% (old: 10.1%; see Fig. 9). We slightly reduced

TP by 3% as we revised down 22F-28F EBITDA by 2-4%. We downgrade to Hold

and argue share price might be more volatile given: 1) Telkomsel in last earning

call said further pricing increase might be limited (depend on competition); 2)

Slightly more uncertainty in outer Java’s long-term growth (slightly higher

competition risk). Our TP translates to 19F EV/EBITDA of 9.4x, 6% premium to

+1STD of 8-yr mean.

TLKM trades at 19F EV/EBITDA of 8.6x, near +1STD.

Risks (page 5).

There might still be downslide risk from concern on Telkomsel’s

network gap (leadership strength) in outer Java vs. peers (depends on realization

progress of other telcos’ expansion to outer Java). Upside risk: If network roll-out

(capex realization) from competitors, incl. Indosat, is significantly lower than its

target; no sufficient funding (balance sheet limitation) for competitor(s) to

support aggressive capex.

Telkom

(

TLKM IJ

)

28 November 2018

Company Update

HOLD

(from Buy)

Year To 31 Dec 2016A 2017A 2018F 2019F 2020F

Revenue (RpBn) 116,333 128,256 133,250 144,567 158,844

EBITDA (RpBn) 59,498 64,609 60,255 63,591 69,145

Source: TLKM, IndoPremier Share Price Closing as of : 28-November-2018

2

Refer to Important disclosures on the last of this report

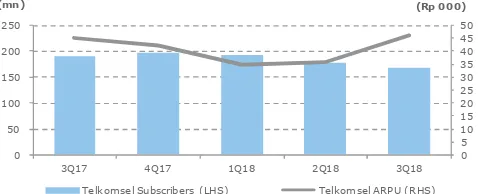

Fig. 1: Tsel’s subscriber base and ARPU Fig. 2: Telkomsel’s data traffic vs. effective data yield

0

Telkomsel Subscribers (LHS) Telkomsel ARPU (RHS)

We expect subscriber base still slightly decline in 4Q18F, but ARPU to increase as subscriber adjusting behaviour to operators’ marketing and pricing strategy post- registration of prepaid card.

0

2Q17 3Q17 4Q17 1Q18 2Q18 3Q18

(Rp/MB) (PB)

Data traffic (LHS) Effective yield (RHS)

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 4: TLKM’s Indihome Subscribers and ARPU Fig. 5: TLKM’s expenses excl. D&A (3Q18)

0

3Q17 4Q17 1Q18 2Q18 3Q18

(Rp 000) (mn)

Indihome Subscriber Indihome ARPU

Personnel

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 5: 2015-20F Tsel’s revenue based on service type Fig. 6: TLKM’s hist-fw. EV/EBITDA (adj. to ownership in Tsel)

0

2015 2016 2017 2018F 2019F 2020F

(

Voice Data SMS Digital service Others

4

TLKM Fw-EV/EBITDA Fw-EV/EBITDA avg (LHS)

Fw-EV/EBITDA + 1 STD (LHS) Fw-EV/EBITDA - 1 STD (LHS)

23 Nov 2018 at 9.0x

-2STD 4.6 -1STD 6.0 Avg. 7.5 +1STD 8.9 +2STD 10.3

3

Refer to Important disclosures on the last of this report

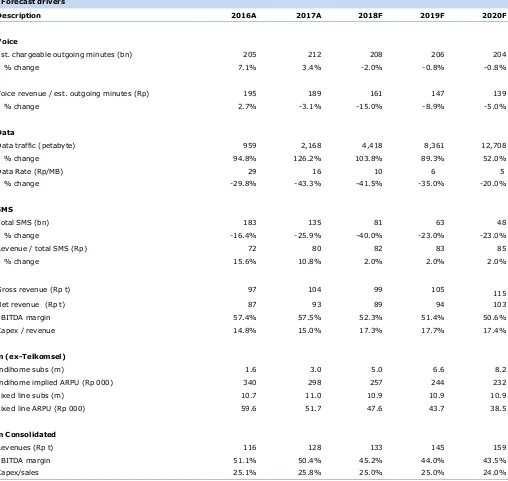

Fig. 7: Forecast drivers4

Refer to Important disclosures on the last of this report

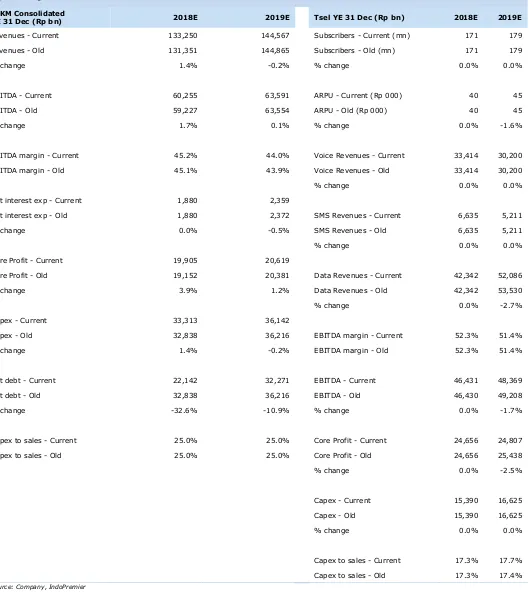

Fig. 8: Change in estimates5

Refer to Important disclosures on the last of this report

Fig. 9: Risk-free-rate and terminal EV/EBITDA assumptionsRisk-Free rate 8.0%

Equity market risk premium 6.0%

Beta 0.80 (old 0.77)

Cost of equity 12.8% (old 12.6%)

Post-tax cost of debt 6.0%

Debt/Capital ratio 38%

WACC 10.2% (old. 10.1%)

Terminal EV/EBITDA Telkomsel: 8x

Non-Telkomsel: 6x

Note: If we use old WACC of 10.1%, our TP would increase by 2% to Rp4,200, assuming all else the same.

Source: Company, IndoPremier, Bloomberg

Risks

Upside risk:

Data revenue growth (traffic and pricing); Telkomsel’s Java

monetization; Indihome’s productivity and monetization; cost saving; if

aggressive (capex realization) network roll-out from competitors, incl. Indosat, is

significantly lower than those competitors’ target; no sufficient funding available

(balance sheet limitation) for competitor(s) to support aggressive capex.

6

Refer to Important disclosures on the last of this report

Year To 31 Dec (RpBn) 2016A 2017A 2018F 2019F 2020F

Income Statement

Net Revenue 116,333 128,256 133,250 144,567 158,844

Cost of Sales 0 0 0 0 0

Gross Profit 116,333 128,256 133,250 144,567 158,844

SG&A Expenses (75,367) (84,093) (93,014) (102,822) (113,382)

Operating Profit 40,966 44,163 40,236 41,745 45,462

Net Interest (1,094) (1,335) (1,880) (2,414) (3,174)

Cash & Equivalent 31,238 27,318 22,138 20,173 18,333

Receivable 7,900 9,564 9,741 10,568 11,612

Inventory 584 631 656 711 781

Other Current Assets 7,979 10,048 10,283 10,991 12,009

Total Current Assets 47,701 47,561 42,817 42,443 42,734

Fixed Assets - Net 114,498 130,171 144,746 160,495 176,560

Goodwill 0 0 0 0 0

Non Current Assets 15,565 18,604 29,292 37,150 47,923

Total Assets 179,611 198,484 219,352 242,993 270,596

ST Loans 911 2,289 1,401 1,744 1,916

Payable 13,690 15,791 0 17,711 19,460

Other Payables 20,640 22,087 22,574 24,393 26,722

Current Portion of LT Loans 4,521 5,209 6,406 3,053 4,284

Total Current Liab. 39,762 45,376 47,268 46,901 52,382

Long Term Loans 26,367 27,974 37,568 49,515 56,231

Other LT Liab. 7,938 13,004 15,560 20,041 26,427

Total Liabilities 74,067 86,354 100,397 116,457 135,040

Equity 7,769 7,817 8,031 8,031 8,031

Retained Earnings 76,615 84,896 88,192 93,842 100,426

Minority Interest 21,160 19,417 22,732 24,663 27,099

Total SHE + Minority Int. 105,544 112,130 118,955 126,535 135,555

Total Liabilities & Equity 179,611 198,484 219,352 242,993 270,596

7

Refer to Important disclosures on the last of this report

Year to 31 Dec 2016A 2017A 2018F 2019F 2020F

Cash Flow

Net Income (Excl.Extraordinary&Min.Int) 29,172 32,701 28,535 29,261 31,460

Depr. & Amortization 4,628 3,479 18,738 20,393 22,058

Changes in Working Capital 4,154 (336) 708 930 1,788

Others (10,123) (9,290) (6,746) (7,380) (7,181)

Cash Flow From Operating 27,831 26,554 41,235 43,203 48,125

Capital Expenditure (18,237) (22,191) (44,000) (44,001) (48,895)

Others 3,023 431 3,077 609 453

Cash Flow From Investing (15,214) (21,760) (40,923) (43,392) (48,442)

Loans (2,813) 3,673 9,903 8,937 8,119

Equity 1,996 0 (2,541) 0 0

Dividends (13,547) (16,609) (14,929) (15,434) (16,513)

Others 3,291 414 6,456 3,970 5,784

Cash Flow From Financing (11,073) (12,522) (1,110) (2,527) (2,610)

Changes in Cash 1,544 (7,728) (799) (2,715) (2,928)

Financial Ratios

Gross Margin (%) 100.0 100.0 100.0 100.0 100.0

Operating Margin (%) 35.2 34.4 30.2 28.9 28.6

Pre-Tax Margin (%) 32.8 33.3 28.8 27.2 26.6

Net Margin (%) 16.6 17.3 14.9 14.2 13.9

ROA (%) 11.2 11.7 9.5 8.9 8.6

ROE (%) 19.5 20.3 17.2 16.8 16.8

ROIC (%) 18.6 19.3 15.7 14.5 14.0

Acct. Receivables TO (days) 24.7 24.9 26.4 25.6 25.5

Acct. Receivables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Inventory TO (days) 0.0 0.0 0.0 0.0 0.0

Payable TO (days) 0.0 0.0 0.0 0.0 0.0

Acct. Payables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Debt to Equity (%) 30.1 31.6 38.1 42.9 46.1

Interest Coverage Ratio (x) 0.1 0.1 0.1 0.1 0.1

Net Gearing (%) 1.9 9.2 19.5 27.0 32.5

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period

HOLD : Expected total return between -10% and 10% within a 12-month period

SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analysts personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS